£65bn Capital Gains 'hotspots' revealed

More capital gains tax is paid in one neighbourhood in Kensington than in Liverpool, Manchester and Newcastle combined, a new report has uncovered.

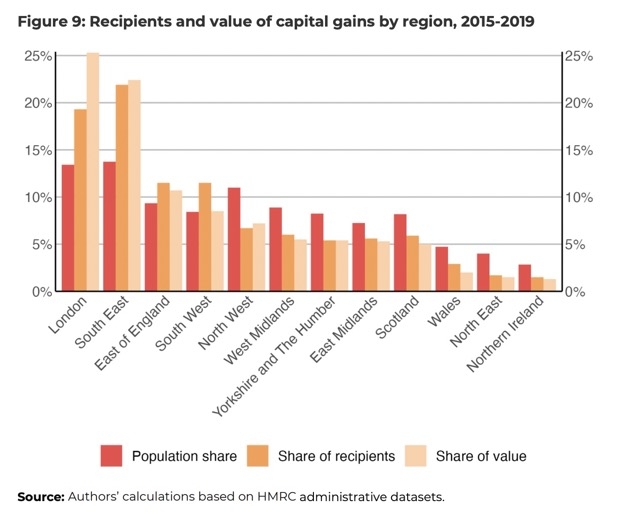

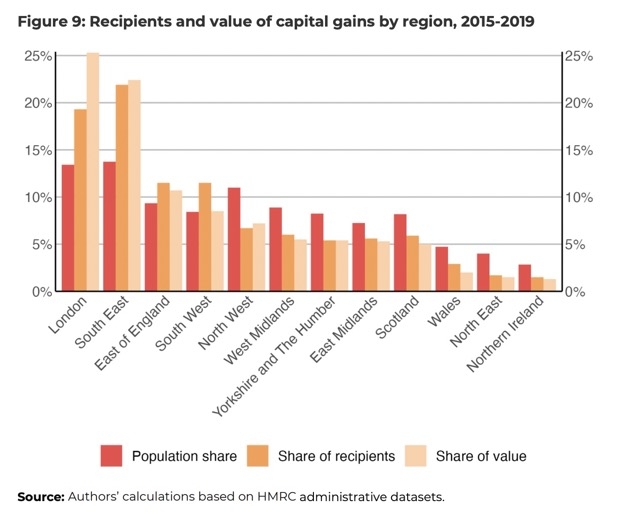

The study found that capital gains, and the likely CGT tax paid, were unevenly spread across the country with the south paying the most.

The study, by researchers at University of Warwick and the London School of Economics, looked at anonymised personal tax returns.

Researchers found that while the amount of capital gains has soared, relatively few people have capital gains.

Total capital gains have almost tripled over the last decade, to £65bn by 2019/20, but less than 3% of adults paid capital gains tax over a 10-year period.

In any given year just 0.5% of adults receive any gains, less than the number of additional rate (“45p”) income tax payers.

The researchers found that capital gains are “incredibly concentrated” on specific areas:

· £3 in every £7 of gains in the UK go to people earning more than £150,000 (In contrast the same group receives only £1 in every £7 in income)

· More than half (52.2%) of all taxable gains in 2020 went to just 5,000 people, who received an average of more than £6.8m per person in gains

· Gains are strongly concentrated in southern England, with more gains in the parliamentary constituency of Kensington than in all of Wales. One neighbourhood of Kensington, comprising just 6,400 people, had more gains than three major cities combined: Liverpool, Manchester and Newcastle.

· Someone living in Kensington is more than 50 times as likely to receive gains as someone in Barking.

The study analysed the anonymised personal tax returns of everyone who received taxable capital gains between 1997 and 2020.

A capital gain is the money received from selling an investment for more than the purchase price. Rates of tax on capital gains (CGT) vary between 10% and 28% depending on the taxpayer’s income level and the type of asset sold. Capital gains tax rates are always lower than income tax rates for the same person, with reliefs in place that allow up to £10m to be received at a 10% tax rate even for the highest rate taxpayers.

The preferential rates benefit few people, who are largely well-off. Just 0.3% of people with income under £50,000 had taxable gains in an average year, but that rose to almost 40% of taxpayers with incomes over £5m receiving some gains. The median gainer in the wealthier group received £372,000 in gains in an average year, benefiting substantially from the gap between capital gains tax and income tax rates.

The top 50,000 gainers – who make up about 0.1% of UK adults – received 86.4% of gains, worth £56bn in total, with each person receiving at least £143,000.

Before reforms in 1998, capital gains tax was progressive: those with the highest gains paid a higher share in capital gains tax. Since the early 2000s, by when the 1998 reforms had fully taken effect, capital gains tax has largely been neutral among top gainers. Under the ‘taper relief’ regime in the 2000s it was in some years regressive.

Arun Advani, associate professor at the University of Warwick’s economics department and CAGE Research Centre, said: “Capital gains are absurdly concentrated, with half the gains in the entire country going to as many people as could fit in the Albert Hall. Less than one in thirty people have any gains at all over the course of a decade.”

Andrew Lonsdale, research officer at LSE’s International Inequalities Institute (III), said: “There are more capital gains in Kensington than the whole of Wales, and more in Hampstead and Kilburn than the North East of England. Continuing to tax these gains at a lower rate than earnings from work is the complete opposite of ‘levelling up’.”

Andy Summers, associate professor at LSE Law School and III, said: “Although not common in the wider population, capital gains are a standard way to receive remuneration for the super-rich. This makes the tax break for capital gains particularly regressive.”

• CAGE Policy Brief Who would be affected by Capital Gains Tax reform by Arun Advani, Andrew Lonsdale, and Andy Summers: https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/bn40.2024.pdf