CPI inflation eased in February

CPI inflation dipped to 2.8% in February in a boost for the Chancellor who will today present her Spring Statement in the commons.

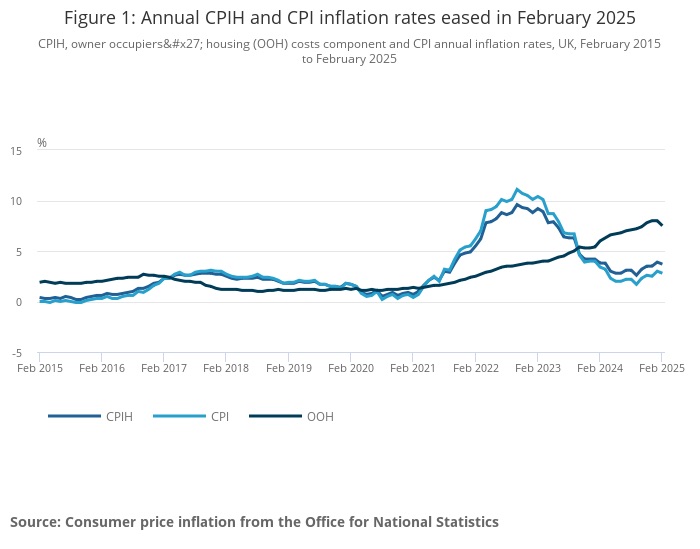

The Consumer Prices Index (CPI) rose by 2.8% in the 12 months to February 2025, down from 3% in the 12 months to January.

The fall was greater than expected and provides some indication that inflation is not out of control but experts have warned that prices rises in many areas, such as council tax and energy bills in April will fuel upward press on inflation.

Chancellor Rachel Reeves will present her Spring Statement at approximately 12.30pm with coverage on Financial Planning today. She is expected to announce spending cuts.

On a monthly basis, CPI rose by 0.4% in February 2025, compared with a rise of 0.6% in February 2024.

The Consumer Prices Index including owner occupiers' housing costs (CPIH), rose by 3.7% in the 12 months to February 2025, down from 3.9% in the 12 months to January. On a monthly basis, CPIH rose by 0.4% in February 2025, compared with a rise of 0.6% in February 2024.

ONS said that the largest downward contribution to the CPIH and CPI annual rates was from clothing, with a further large downward effect in CPIH from housing and household services.

Core CPIH (excluding energy, food, alcohol and tobacco) rose by 4.4% in the 12 months to February 2025, down from 4.6% in the 12 months to January. The CPIH goods annual rate slowed from 1.0% to 0.8%, while the CPIH services annual rate eased slightly from 5.8% to 5.7%.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.5% in the 12 months to February 2025, down from 3.7% in the 12 months to January; the CPI goods annual rate slowed from 1.0% to 0.8%, while the CPI services annual rate was unchanged at 5.0%.

RPI, the older measure of inflation, fell from 3.6% in January to 3.2% in February.

Nathaniel Casey, investment strategist at wealth manager Evelyn Partners, said: "Both core and headline CPI came in just below consensus expectations in February. Nonetheless the UK continues to face stickier inflationary pressures compared with other advances economies. This has been reflected in the bond market, with gilt yields remaining higher than their European counterparts such as German bunds, even as both markets face a similarly weak growth profile.

"While the February inflation data came in below economists’ expectations, it follows a stronger than expected set of figures in January and remains stubbornly above the Bank of England’s target of 2%. The BoE expects inflation to accelerate higher over course of 2025, before slowly returning to target in 2026.

"All eyes will be on the Chancellor of the Exchequer Rachel Reeves later today as the Office of Budget Responsibility (OBR) is expected to deliver a downgraded UK growth outlook which could wipe out the fiscal headroom that she created during the Budget last Autumn. With a slashed growth outlook and inflation still proving stubborn, Reeves faces a challenging task later today when she delivers her Spring Statement as she tries to balance the economy’s need for growth while balancing the books and staying within her own fiscal rules."

Luke Bartholomew, deputy chief economist, at Aberdeen, said: "Both the Bank of England and the Chancellor will be somewhat relieved by the drop in headline inflation. Though inflation is still running well ahead of target and is still likely to increase later this year. So this report does not fundamentally change the outlook for inflation, but it should keep the path clear for another interest rate cut in May.

"In the meantime, slightly lower inflation should also mean less pressure on gilt yields, which remain a major concern for the Chancellor as she prepares for her Spring Statement later today. While the broad contours of that announcement are well understood, the market reaction will likely turn on how much the spending reductions are front-loaded versus back-loaded, with back-loaded cuts more likely to stretch credibility and risk a more adverse market move.”