- Home

- News

Investors pump £4bn into funds in April

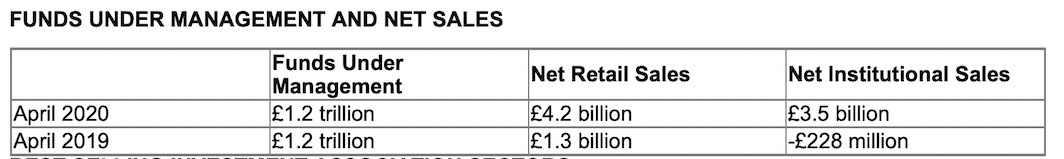

After record outflows of £10bn in March, UK savers pumped £4bn back into retail funds in April, according to figures from the Investment Association published today.

There also appeared to be a trend towards actively-managed equity funds, said the IA.

Active funds saw net retail sales of £2.7bn in April, nearly double the net retail sales of tracker funds.

ISA funds saw £1.1bn in net retail sales in April and socially responsible investment funds saw record net retail sales of £969m.

Source: IA, April 2020 Fund Sales Data

The five best-selling Investment Association sectors for April were:

Global was first with net retail sales of £1.2bn.

UK All Companies was second with net retail sales of £874m.

£ Corporate Bond followed with net retail sales of £535m.

Mixed Investment 40-85% Shares was fourth with net retail sales of £530m.

£ High Yield was fifth with net retail sales of £312m.

The worst-selling IA sector was Targeted Absolute Return with an outflow of £491m.

Global was the best-selling equity fund region with net retail sales of £1.2bn followed by UK funds with net retail inflows of £1bn and Asia funds with £221m of sales.

Responsible investment funds under management stood at £29bn at the end of April and had a share of Funds under Management of 2.4%.

Trackers had a market share of 18%.

Gross retail sales for UK fund platforms totalled £12.3bn, a market share of 49%. Gross retail sales through ‘Other UK Intermediaries’, including IFAs, were £6.6bn, a market share of 26%. Direct gross retail sales were £2bn, a market share of 8%.

Chris Cummings, chief executive of the Investment Association, said: “After record outflows from the fund market as global lockdown measures began in March, savers returned to put £4 billion into retail funds in April. Part of this comeback was fuelled by record inflows into responsible investment funds in April.

“Both active and passive funds benefited from the return to inflows in April. Bond funds gathered £903 million in assets, suggesting some of March’s record redemptions flowed back quickly as we moved past the initial market turbulence of the Covid-19 pandemic.”