- Home

- News

Sharp fall in CPI from 10.1% to 8.7%

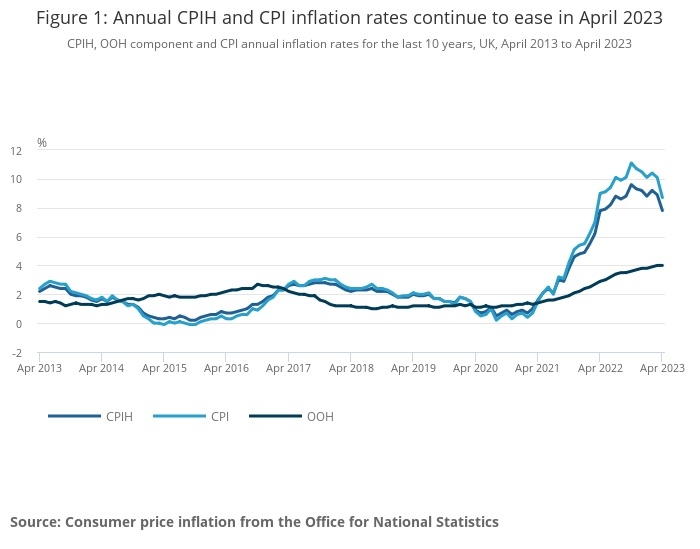

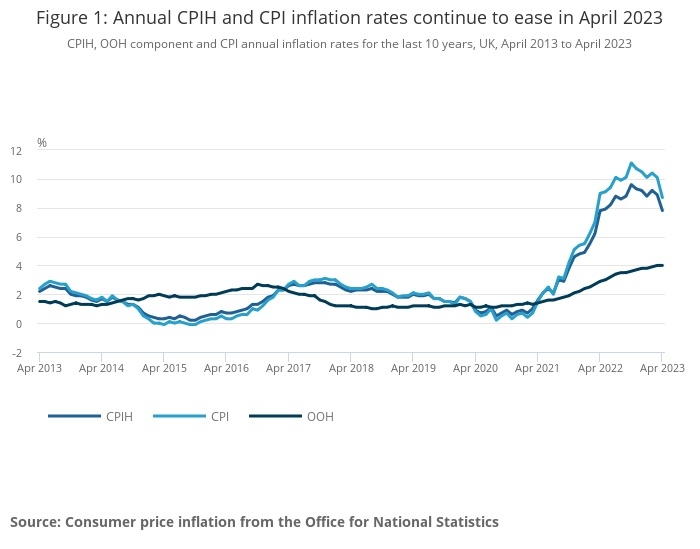

CPI inflation has dropped significantly from 10.1% in March to 8.7% in April, latest figures from ONS released today show.

CPI inflation is below 10% for the first time since last summer.

The news will provide some comfort for hard-pressed consumers struggling with surging prices.

On a monthly basis, CPI rose by 1.2% in April 2023, compared with a rise of 2.5% in April 2022, suggesting recent accelerated increases in inflation are slowing down.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.8% in the 12 months to April 2023, down from 8.9% in March.

The inflation rate using the older RPI measure dropped from 13.5% in March to 11.4% in April.

The drop in CPI inflation was helped by falling gas and electric prices which contributed a 1.42% fall in annual inflation in April.

However, food and non-alcoholic drink prices continued to rise in April, albeit at a slower rate. The annual inflation rate for food and non-alcoholic beverages eased slightly from 19.2% in the year to March 2023 to 19.1% in April 2023.

ONS said: "The easing in the annual inflation rate in April 2023 mainly reflected price changes in the housing and household services division, particularly for gas and electricity. This was offset partially by upward effects coming from recreation and culture, alcoholic beverages and tobacco, communication and transport."

Reaction from the industry was one of caution and concern that inflation was proving difficult to tame and was unsettling financial plans.

Andrew Tully, technical director at Canada Life, said: “Consumers might be breathing a sigh of relief that inflation has dipped below double-figures for the first time since October, but prices remain high for the everyday goods and services we all consume on a daily basis. Today’s numbers spell out that prices are just not going up as fast as previously.

“This creates a challenge for people on fixed incomes, or those households who haven’t experienced an inflation-busting pay rise, who will need to stay creative to save money, and keep themselves in the black."

Jonny Black, chief commercial and strategy officer at abrdn, Adviser, said: “The Bank of England has indicated that this is just the start of a significant drop in inflation over the coming months, helped by falling energy prices.

“But it has also admitted that the knock-on effects in areas like wages and prices will be ‘sticky’ factors, keeping inflation still at high levels for longer. This could mean interest rates stay held at their current 4.5%, or climb even higher when the Monetary Policy Committee meets again next month.

“The start of what could be larger drops in inflation makes it more and more important for advisers to highlight to clients that lower inflation does not mean prices are coming down – it just means they’re increasing more slowly. Falling inflation is good news, but in the majority of cases it won’t be a reason for radical departure from what will be carefully developed, long-term plans. Advisers will have a critical role to play in ensuring that clients stay the course, whatever the coming months bring.”

Richard Carter, head of fixed interest research at Quilter Cheviot, said: "The latest figures come as the International Monetary Fund (IMF) backtracked on its previous estimation that the UK would be the worst performing economy in the G7, instead concluding that it will achieve 0.4% growth in 2023 and will manage to avoid a recession.

"The IMF’s change of heart was largely as a result of unexpected resilience in demand, with continued government support and falling energy costs each playing a part, though it still predicts inflation will be sticky and does not expect a return to its 2% target for a further three years.

“While this fall in inflation shows things are beginning to move in the right direction, we cannot ignore the fact that there is an incredibly long way to go. Inflation at 8.7% is still eye-wateringly high with prices rising steeply, and we are unlikely to see such significant eases as this in the coming months. Instead, we can expect to see a more gradual decline, particularly if the IMF’s prediction is accurate."

Simeon Willis, chief investment officer at SIPP provider XPS Pensions Group, said: “In April last year prices rose by 2.5% in one month, heavily linked to energy price rises. Losing this upward spike in prices from the 12 month calculation was expected to bring inflation down markedly and it has.

"However, prices are still rising too fast and today’s headline figure was higher than expected. Price increases over the last 3 months alone exceed the Bank of England’s annual target. April is typically the most volatile month of the year for price increases, and on average sees higher price increases than other months. As such, there is still scope for lower inflation to materialise in the coming months.”

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/