CPI falls to 7.9% - lowest for a year

CPI inflation has fallen to 7.9% for the year to June, the lowest level seen for over a year.

The fall in CPI was driven by falling fuel prices and was better than expected, according to the figures from the Office for National Statistics.

Inflation fell from 10.1% in March to 8.7% in April, but remained at 8.7% in May.

The Bank of England CPI target remains 2%.

Key CPI figures:

-

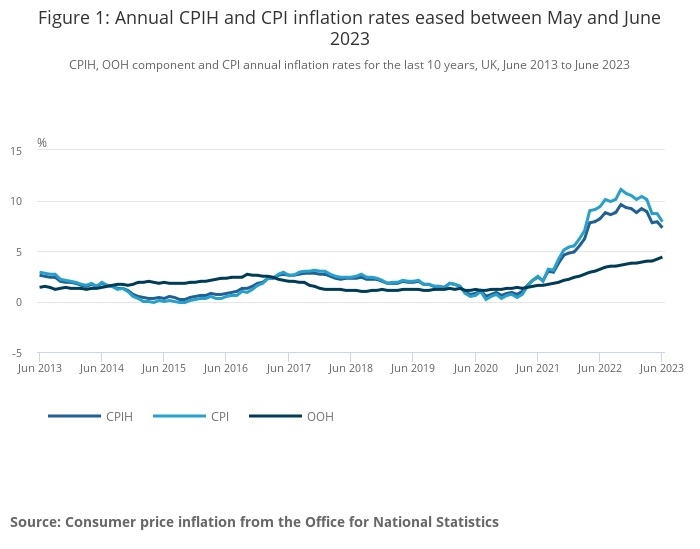

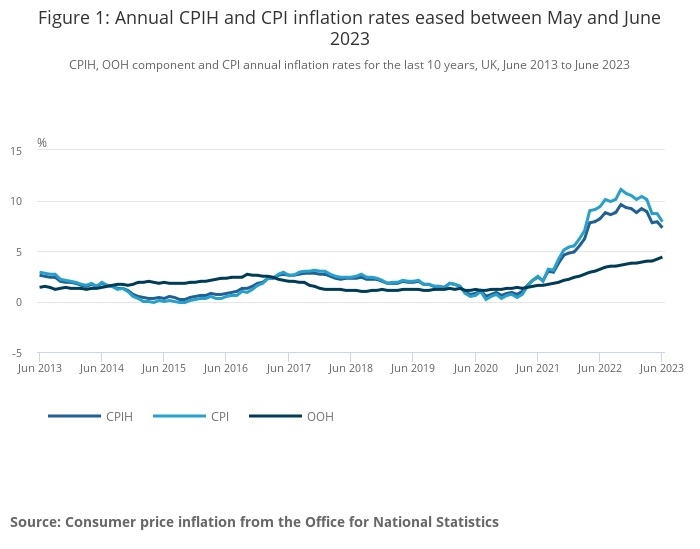

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May.

-

On a monthly basis, CPIH rose by 0.2% in June 2023, compared with a rise of 0.7% in June 2022.

-

The Consumer Prices Index (CPI) rose by 7.9% in the 12 months to June 2023, down from 8.7% in May.

-

On a monthly basis, CPI rose by 0.1% in June 2023, compared with a rise of 0.8% in June 2022.

-

Falling prices for motor fuel led to the largest downward contribution to the monthly change in CPIH and CPI annual rates, while food prices rose in June 2023 but by less than in June 2022, also leading to an easing in the rates.

-

Core CPIH (excluding energy, food, alcohol and tobacco) rose 6.4% in the 12 months to June 2023, down from 6.5% in May, which was the highest rate for over 30 years; the CPIH goods annual rate slowed from 9.7% to 8.5%, while the CPIH services annual rate was 6.3%, unchanged from May.

-

Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.9% in the 12 months to June 2023, down from 7.1% in May, which was the highest rate since March 1992; the CPI goods annual rate slowed from 9.7% to 8.5%, while the CPI services annual rate eased from 7.4% to 7.2%.

- CPI was 2.5% in June 2021.

-

The older measure of inflation, RPI, fell from 11.3% to 10.7% in June.

While today’s fall was welcomed, some Financial Planners and wealth managers remained sceptical.

Tom Hopkins, portfolio manager at BRI Wealth Management, said: "UK headline inflation came in at 7.9%, the lowest level since March 2022 and beating consensus expectations of 8.2%.

"This is the first time in four months that the inflation figure for the UK has not exceeded forecasts in what should be digested as positive news for the UK markets. Core Inflation also fell back from its 31 year high of 7.1% to 6.9%.

"Downward pressures on inflation in June is likely to have come from auto fuel and food prices, which jumped in the same month a year earlier. Today’s Inflation print will be somewhat reassuring, however we still expect another interest rate rise in the UK at the Bank of England's next meeting in August, albeit more likely a 0.25% rise now with further rises in Q3 and Q4.

"While today's print will be seen as a positive, the UK is still behind the US and Eurozone in its fight against inflation. Therefore rates need to continue rising with the burden of higher borrowing costs continuing to be faced by households and corporates."

Others said they expected high inflation to remain for some time.

Kirsty Watson, chief operating officer at Abrdn Adviser, said: “These results show that inflation is slowly making its way back down the scale. But with inflation still set to remain higher, for some time longer, a big question that clients will be asking is whether they should be taking greater advantage of slowly rising cash rates, if they’re not already.

“While the ‘right’ answer will naturally depend on individual circumstances, it’s important that clients keep in mind the benefits of keeping a long-term view through their investments. In such a dynamic environment, the value of advice will be in helping clients quickly make changes to capitalise on changes in the economic and investor landscape – but crucially to do so without putting their long-term financial goals at risk.”

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/