CPI drops from 7.9% to 6.8%

Falling energy prices pushed down the rate of CPI inflation substantially in July to 6.8% but the figure remains well above the Bank of England's 2% target.

Experts said the figure would put pressure on the Bank of England to raise interest rates again, with a small rise in CPI possible in August.

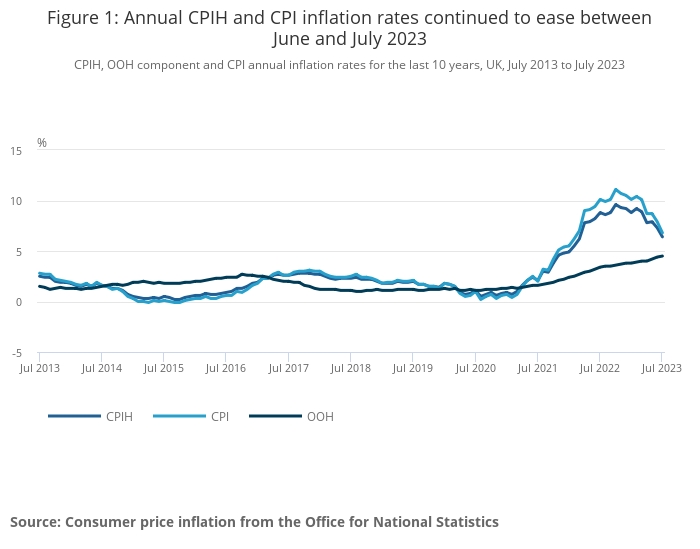

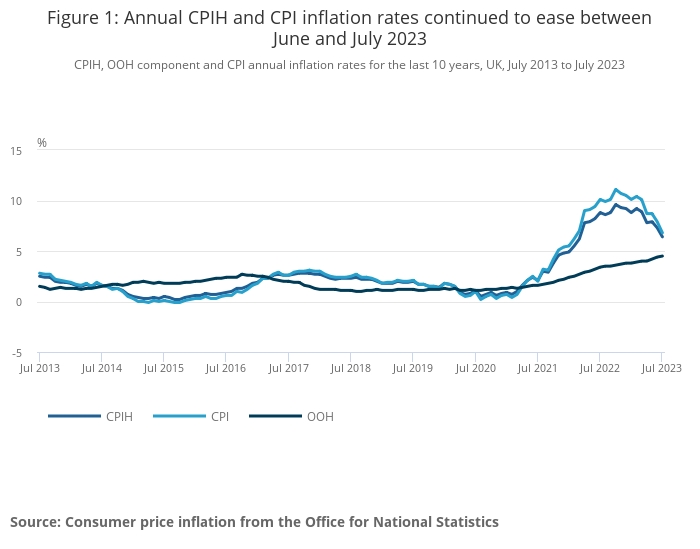

Figures released by ONS today show the Consumer Prices Index (CPI) in the 12 months to July rose by 6.8%, down from 7.9% in June.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose 6.4% in the 12 months to July 2023, down from 7.3% in June.

Inflation is continuing to trend downwards after reaching a high of over 10%.

On a monthly basis, CPI fell by 0.4% in July 2023, compared with a rise of 0.6% in July 2022.

On a monthly basis, CPIH fell by 0.3% in July 2023. It rose by 0.6% in July 2022.

RPI, the older measure of inflation, fell from 10.7% in June to 9% in July.

ONS said that falling gas and electricity prices were the main downward contributions to the monthly change in CPIH and CPI annual rates.

Food prices, a concern for many consumers recently, rose in July 2023 but by less than in July 2022, also helping ease annual inflation rates.

Hotels and air passenger transport were the classes that provided the largest upward contributions to the change in the rates, ONS said.

Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.9% in the 12 months to July 2023, unchanged from June. The CPI goods annual rate slowed from 8.5% to 6.1%, while the CPI services annual rate rose slightly from 7.2% to 7.4%.

Steven Cameron, pensions director at Aegon suggested that state pensioners should ‘hold onto their hats’ ahead of confirmation of the pensions Triple Lock in October.

He said: “With earnings growth rising and the headline rate of inflation falling, the stakes are high for next year’s state pension triple lock. If earnings growth next month stays at the latest figure of 8.2%, state pensioners will be guaranteed this level of increase next April. This is now 1.3% above the latest inflation figure of 6.9% and if the Government achieves its plans, could be well above the ruling inflation rate when it comes into payment next April.

“But with so much volatility, the state pension Triple Lock has become quite the roller coaster, so it’s time to ‘hold onto your hats’ for a couple of months. The final earnings component will be announced next month and the final inflation figure in October. But after a double digit 10.1% increase in April 2023, state pensioners could be in for an inflation busting boost in April 2024.”

Jonny Black, chief commercial and strategy officer at Abrdn, Adviser, said: “Falling inflation and high interest rates will mean some clients will be wanting to review whether their portfolio composition is still right for them.

“Circumstances are going to dictate individual actions. But what’s going to be common to every case is the value of an advisers’ reassurance.

“In what is still a complex economic and financial environment, ‘good’ advice will be about building clients’ confidence that their strategy puts them in the best position they can be given everything we know about what’s driving inflation and where it’s likely to go.”

Marc O’Sullivan, head of investments at financial mutual Wesleyan, said: “While inflation is still too high, a clear downward trajectory is emerging with inflation forecasts starting to cool. The big question now is what this means for interest rates.

“Monetary policy operates with a long time-lag so we believe the Bank of England will eventually pause its sequence of consecutive rate rises in the coming months, not least to monitor the impact that higher interest rates will be having on the consumer and therefore the economy."

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/