NextWealth predicts ‘seismic shift’ in advice firms' structures

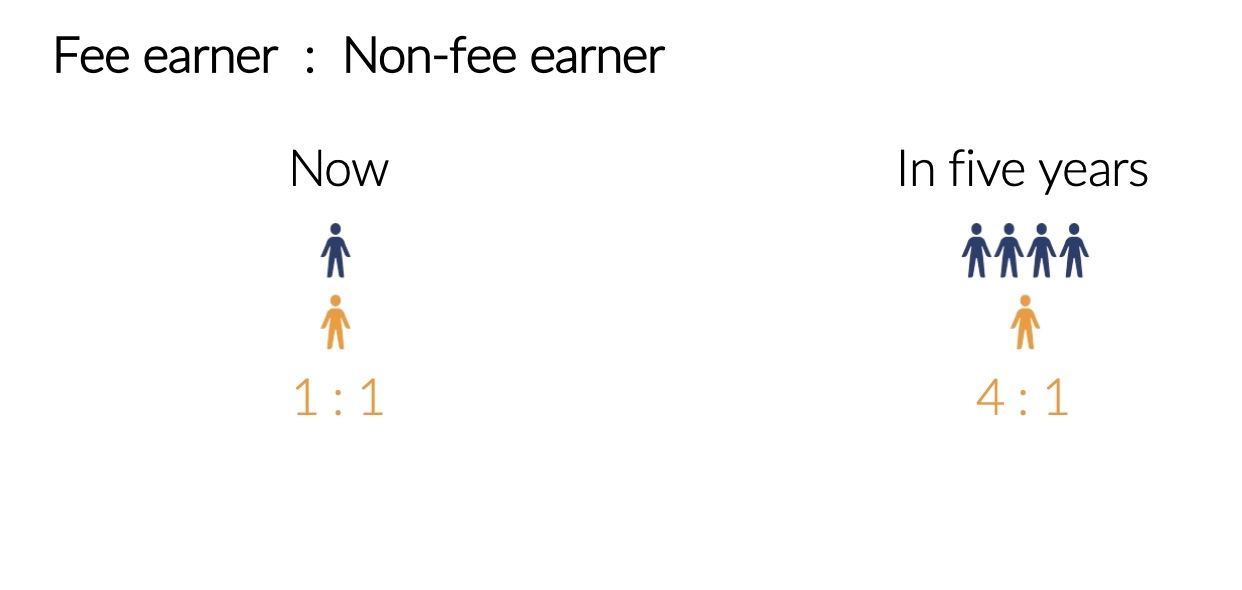

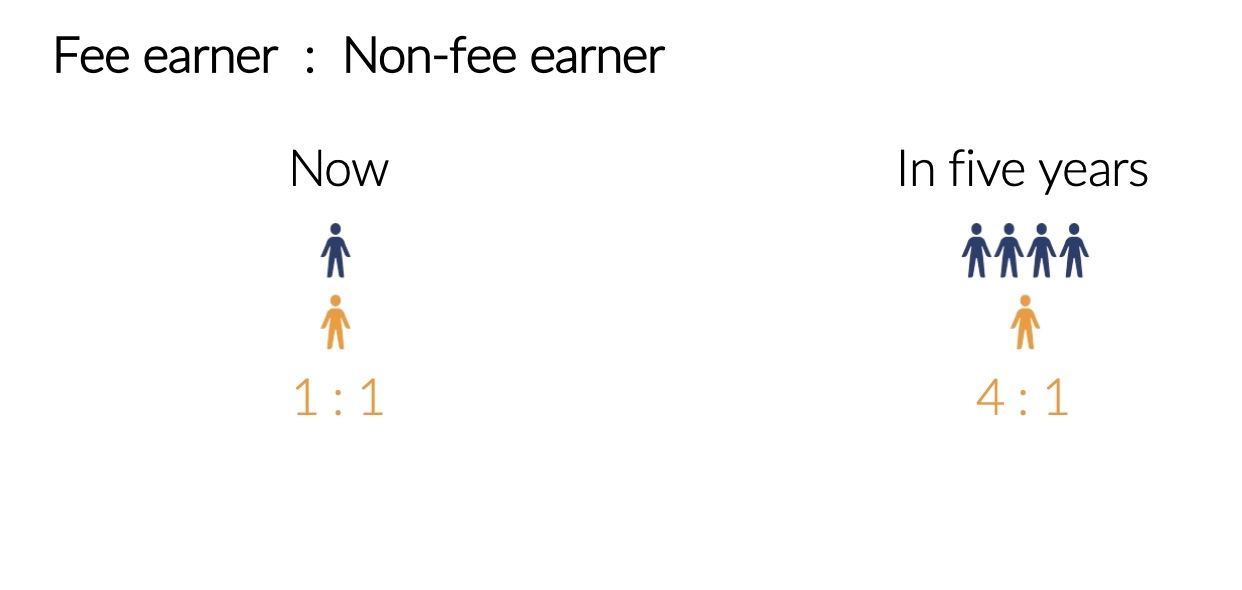

Wealth consultancy NextWealth has predicted a "seismic shift" in advice firm structures over next five years with the fee earner to non-fee earner ratio moving from 1:1 to 4:1.

NextWealth predicts that fee-earners - mainly advisers - will need far fewer support staff in five years due to technological advances.

NextWealth also expects the planner/adviser to client ratio to increase from 1:94 to 1:250 in five years with far more clients supported by each adviser.

It makes the predictions in a new report published today called 'Delivering Operational Leverage.'

The consultancy forecasts that momentous change in the advice sector will be driven by improved efficiency, the streamlining of the advice process and a change in culture in large financial advice firms looking to drive revenue growth.

It said a variety of Financial Planning business models will thrive but all will be pushed to reduce time and resource on admin tasks.

Heather Hopkins, NextWealth’s managing director said: “We are seeing big changes in the way firms are gearing up for the future. Larger firms in particular are focusing on how they can use tech to save time, reduce overheads and service more clients. This has particular ramifications for back office and platform suppliers.”

The report highlights how consolidation in the adviser space is creating larger advice firms which are prepared to invest in infrastructures that will maximise efficiencies.

Heather Hopkins said: “Large financial advice firms have the clout to demand more of their suppliers and will build their own links in the system of record to support the system of engagement, which includes client portal, cashflow modelling and risk profiler."

She said the system of engagement will either be bespoke built or heavily tailored to suit firms’ brand and processes requirements. They will require APIs from platforms and back-office systems to deliver rising regulatory reporting requirements and a client experience that they define.

The report suggested that small firms will use off-the-shelf solutions, relying on tech partners to deliver required integrations, with some opting for a single source approach (integrated back-office and platform).

Predicted implications for back-office system providers:

- Customisation: Greater customisation of data feeds to advice firms. These will need to meet requirements for MI to report to shareholders, the regulator and clients.

Specific examples mentioned in NextWealth interviews included commission and fee payments, client data (portfolio value, clients per adviser, profitability by client, meeting frequency, client and prospect marketing metrics) and client portfolio data to feed client portals.

Predicted implications for platforms:

- APIs: Requirement for enhanced APIs to populate data lakes. Data lakes will increasingly feed client reporting engines, client portals, accounting systems and business dashboards.

- Fewer platform partners: Advice firms will work with fewer platforms as they streamline their system of record. The trend of shrinking the number of external partners to fewer strategic partners will continue and possibly accelerate.

- Platform+ models: Where the platform offers some services of a back office combined with a client portal and accounting system will emerge.

• The findings of the report were based on qualitative and quantitative research and insights based on NextWealth’s understanding of the retail wealth market plus interviews with 18 financial advice professionals, a survey of 244 financial advice professionals and interviews and demos with back office system providers.

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/