'Stark' need for education as 99% fail to be financially astute

Research from the Office for National Statistics showing just one in 100 Britons are financially astute is a “stark reminder of the need for immediate action”, a savings body says.

The Savings and Investments Policy project said this was evidence of the need for a clear set of policies and initiatives to increase financial education.

The data came from the ONS Wealth and Assets Survey – Financial Capability.

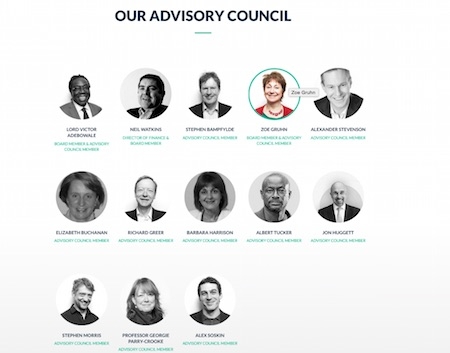

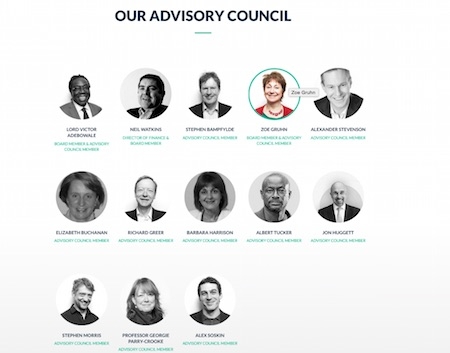

TSIP, a group of over 50 leading financial services companies, trade bodies and consumer groups, published a report called Saving Our Financial Future in March outlining six policy recommendations to rebuild a culture of savings in the UK and restore financial security for households.

{desktop}{/desktop}{mobile}{/mobile}

TSIP is directed by an executive committee formed from Aviva, AXA Wealth, BNY Mellon, BlackRock, Ernst Young, Henderson, J.P. Morgan Asset Management, L&G, Lloyds Banking, Nationwide, Northern Trust, Old Mutual, Pinsent Masons, RBS, Threadneedle Investments and TISA.

One of the six polices recommended by TSIP was to explore ways for the financial services industry to increase financial capability.

It has formed a cross-industry education working group which is looking at making the provision of financial education more effective.

TSIP believes that there must be better coordination between all the various industry, public sector and voluntary bodies currently providing financial education and that there should be greater pooling of the considerable investment to inform consumers of the benefits of saving.

Rupert Pybus, co-sponsor of TSIP’s education working group and global head of marketing at Columbia Threadneedle Investments, said: “This alarming statistic from the ONS study that only 1% of the British public is financially astute must motivate a more co-ordinated approach by government, voluntary and financial groups to encourage people to save for tomorrow. Financial education is at the heart of this and we believe that there is a real opportunity to rebuild confidence and trust in saving and investing.

“We believe creating a strong and accessible financial education system is critical to reversing attitudes and building a society where investing is something we all do naturally. Education must be supported by greater access to financial guidance to ensure the momentum of financial education is backed up by professional assistance.”