TISA says pensions Isa could undermine workplace saving

TISA, the tax-incentivised savings association, is warning that moves towards a pension Isa would be counter-productive as it would destabilise workplace pension saving without offering a superior outcome for savers and would also result in limited future tax revenues.

The view has been developed by TISA’s Savings and Investments Policy project (TSIP) as part of a detailed set of recommendations to incentivise long-term saving including research of consumer preferences.

It says that moving from the current Exempt-Exempt-Taxed (‘EET’) system to a Taxed-Exempt-Exempt (‘TEE’) like Isas and providing a government top-up on pension contributions would raise some major issues. While consumers initially like and understand the concept of a pension Isa as it strikes a positive emotional chord, once the pros and cons are explained there is strong support for the existing EET system whereby incentives are received up-front rather than in the future, says TISA.

TISA has outlined in its response to HMT’s consultation on tax relief five key reasons why a TEE approach would not provide a more beneficial and sustainable approach to incentivising savings:

1. “There is no evidence to suggest that TEE would lead to increased pension savings – it destabilises the current momentum for workplace pension saving without offering a clearly superior outcome.”

2. “The removal of taxed withdrawals in retirement reduces the brake on people spending their pension funds too quickly, something that Australia has already experienced.”

3. “It relies on an expectation of consistency of pension policy over a period of decades when this has been conspicuously absent in recent times.”

4. “There would be significant disruption to the saving expectations of individuals and to employers/providers who have made a major investment in the current pension system and who are accustomed to the flexibility of having both EET and TEE (ISA) saving available to them depending on their circumstances.”

5. “It implies future retiring cohorts would make limited financial contribution to society while consuming high levels of public services, a position which is simply unsustainable.”

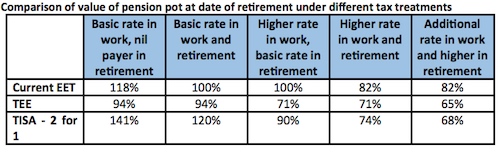

This chart shows the relative position of different taxpayers under EET, TEE and a 2 for 1 matching system. It looks at the value of the post-tax pension pot generated at retirement by a £100 gross pension contribution from each of the different taxpayer groups. The results are shown as the relative size of the pension pot compared to the outcome for a worker who is a basic rate taxpayer both in work and in retirement under an EET system, and so are shown as percentages of this reference group.

Adrian Boulding, policy strategy director of TISA said: “Our research demonstrates that people favour simple, tangible and stable incentives which are contributory in nature. However, the current system has been questioned for some time and its effectiveness as an incentive is difficult to evidence. TEE results in considerably lower outcomes and so would require a significant additional Government contribution, unless all groups are to be losers.

“Our analysis shows that EET is not as regressive as some people suggest. For the same £100 of gross earnings contributed to a pension plan, lower earners generally do better than higher earners. However, we believe that a move to two-for-one matching would be more progressive, the switch benefitting lower earners at the cost of smaller pensions for higher earners.

"We urge the Chancellor to be bold yet simple in his 2016 Budget and move pensions tax relief to the same flat rate of 33% for everyone. That would mean for every £1 you contribute to a pension, George Osborne adds 50 pence."

TSIP is a group of over 50 financial services companies, trade bodies and consumer groups.