Rise in income tax relief claimed by VCT investors

The amount of income tax relief Venture Capital Trust investors claimed on their investments increased last year by 8%, new Government figures show.

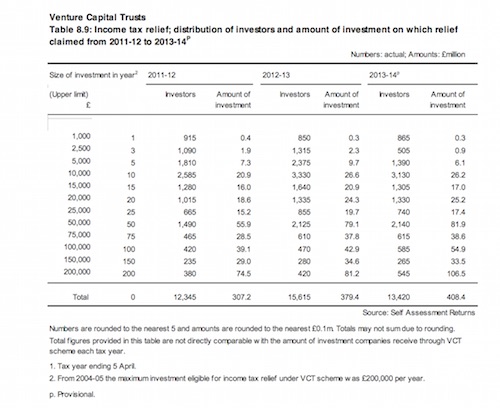

VCT investors claimed income tax relief on £408.4 million of their investment during 2013-14. This was a £29m increase compared with 2012-13.

HMRC officials, who compiled the report, said that the majority of VCT investors tended to invest smaller amounts into VCT funds.

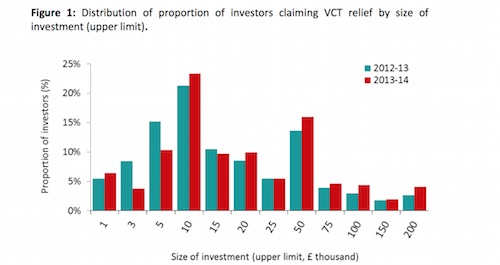

In 2013-14, 44% of investors made a claim for an investment of £10,000 or less and only 6% above £100,000.

In 2013-14, 44% of VCT investors claimed tax relief under the VCT scheme for an investment of £10,000 or less, with the largest group being the £5,000 to £10,000 group (23%). Only 6% of investors made a claim for an investment over £100,000.

Source: www.gov.uk

In comparison to 2012-13, there has been a higher proportion of large investments and the proportion of investors above £25,000 has grown in every category.

Amounts invested between £150,000 and £200,000 accounted for over a quarter (26%) of the total amount of investment in 2013-14.

For all years since 2004-05, those investing £10,000 or less have represented the largest group of investors.

Source: www.gov.uk

Paul Latham, managing director at Octopus Investments, said: “Today’s HMRC statistics demonstrate how VCT investing is becoming increasingly popular for investors seeking a diversified portfolio.

“VCTs can prove to be a valuable investment option for people willing to take on more risk and are seeking to generate additional income or complement their existing retirement plans – especially given restrictions affecting the pensions annual allowance and lifetime allowance from April.

“Given recent legislative changes, investors could be forgiven for thinking that VCTs have been put under greater scrutiny. But crucially, the new legislation does not materially affect the ways VCTs work – it will only help to ensure that investments will target fast-growing companies from those sectors most in need of additional finance.

“Investors will continue to benefit, in the same way as before, from the tax reliefs available, which compensate for the risks of investing into smaller companies.”