Client-facing Financial Planning smartphone tool launched

A new client-facing Financial Planning tool for smartphones has been created to tap into a 15 million strong market of people with investments of between £1,000 and £100,000.

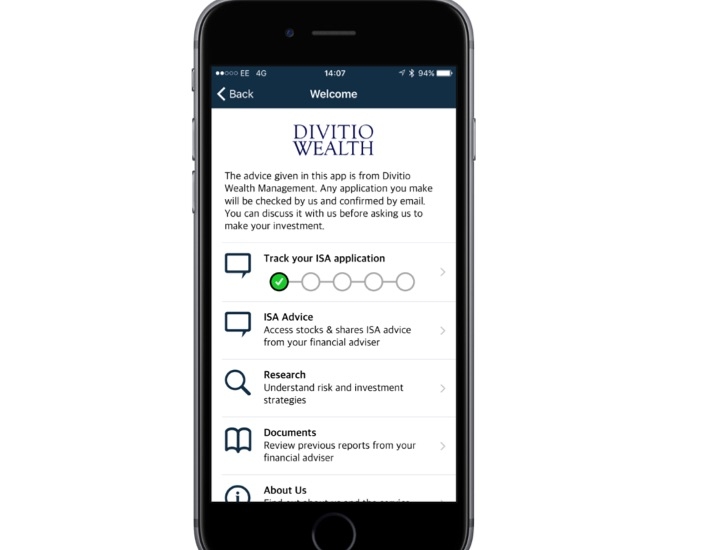

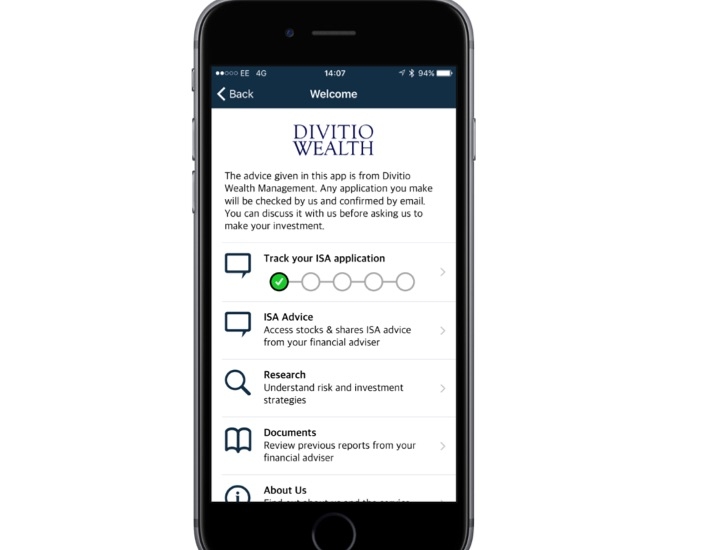

The AccessAdvice™ application, created by Distribution Technology, will be trialled by a group of advisers before a full launch.

It will initially support ISA advice but the firm intends to expand the service to cover more complex needs in the future.

Ben Goss, chief executive of DT, said: “This opens a significant new market, estimated by the ONS and FCA to be 15 million people with investments of less than £100,000 but more than £1,000.”

The price of the final app, which will work for all smartphone users, is yet to be decided. But DT said it wants to make it as accessible as possible for advisers and their clients.

The company said the creation of the app follows completion of in-depth client research and participation in the FCA’s Project Innovate seminars.

A prototype is being tested with advice firms but there is no set date for the development stage to finish.

The company said it was keen to get as much information as possible and ensure it stacks up to compliance.

The company said in a statement: “With the new prototype, DT will begin the process of working with advisers to ensure the service meets their needs. The new client-facing app is designed to enable advisers to service lower value cases via a fully automated, digital advice process and WealthConnect integrations.

“AccessAdvice™ is designed to be white labelled and personalised by the adviser but it will harness the widely followed Dynamic Planner® asset and risk model to ensure ongoing suitability.

“It will also use Dynamic Planner’s platform integration framework, WealthConnect, to enable advisers to check and submit transactions thereby reducing time and risk by eliminating the need for information to be re-keyed.”

Research among DT’s adviser clients found that 88% of respondents would like customers to complete at least part of the advice service themselves digitally while 38% said they would consider adopting automated, self-serve tools over the next 12-24 months.

Mr Goss said: “With the development of this prototype we are signalling our intent to work closely with clients and provide them with the digitally supported advice capabilities they need to engage with today’s consumers. AccessAdvice™ will allow Financial Planners to leverage their trusted brand while delivering self-serve advice supported by the robust Dynamic Planner® asset and risk model.

“We know that the app will need to meet each firm’s stringent compliance requirements and we are working closely with them to ensure that this is the case.

“What was clear from our research is that not all customers and cases are equal and the same approach is not suitable for all. Initial feedback has been excellent with advisers reporting that AccessAdvice™ could revolutionise business by reducing the time to service clients from a few hours to a few minutes.”