Investment managers forecast profit challenges for sector

Profits have fallen in the investment management sector for the first time since 2009 after a turbulent fourth quarter.

While profits were steady during the first half of 2011, they have steadily fallen since the second half.

The results are part of the financial services survey which is conducted quarterly by the Confederation of British Industry (CBI) and PricewaterhouseCoopers (PwC).

The decline is due to problems surrounding the eurozone and market volatility.

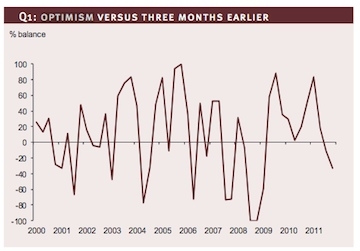

The volume of investment management business also fell for the first time since March 2009. Worryingly, respondents said they expected this trend to continue into 2012. This has caused optimism to fall with respondents continuing to be less optimistic about the future.

A high proportion of respondents indicated a weak level of demand was the most significant obstacle to increasing the level of business in the next year.

Cross sales to new customers and new products were the most popular sources of possible growth in the next three months.

Pars Purewal, UK investment management leader at PwC, said:

“The turmoil in the eurozone and subsequent volatility in markets in the last part of 2011 has led to lower levels of business and fee income among investment management firms and this has been compounded by investors, particularly private clients, switching their capital to low-fee assets.

“Potential further regulatory changes and increasing constraints on capital are also causing concern in the industry.”