98.99% of life claims paid out by Scottish Widows

Scottish Widows has published its protection claims statistics which show that it paid out 98.99% of life claims.

The figures also revealed it paid out 93.06% of critical illness claims last year.

Both life and critical illness pay out rates were above the industry averages of 98% and 92.2% respectively.

The firm revealed that a total of more than £204m was paid out by it in life and critical illness claims in 2017, an average of just under £4m per week.

The number of claims paid for life cover was 7,469 and for critical illness it was 1,769.

The total amount paid out in life claims was £129.4 million, with £13.46 million paid in terminal illness claims.

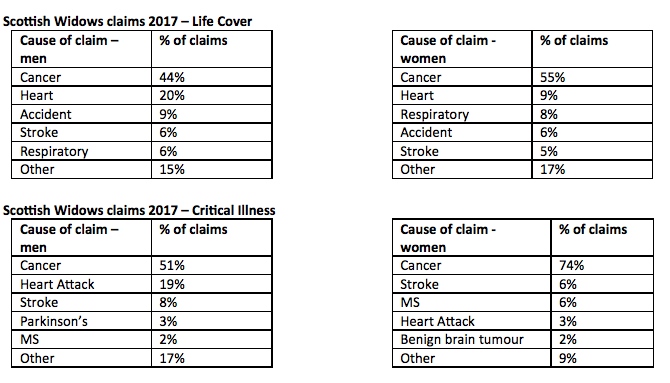

The report also showed that 55% of all life claims from women were as a result of cancer, compared to 44% for men and men accounted for 59% of claims.

The average size of life claims paid was £41,392 and the highest individual claim was £1,001,205.

Critical illness statistics showed the total amount paid out was £75.19m, with the average size of claim paid out standing at £42,506 and the highest individual claim was £400,000.

The youngest adult claimant was 21 and the oldest 79 with women accounting for 53% of all claims.

Scott Cadger, head of underwriting and claims strategy at Scottish Widows, said: “Our research shows that people, on average, believe that only 34% of protection claims are paid out by insurance companies.

"Our claims statistics for 2017, however, separate the facts from fiction.”