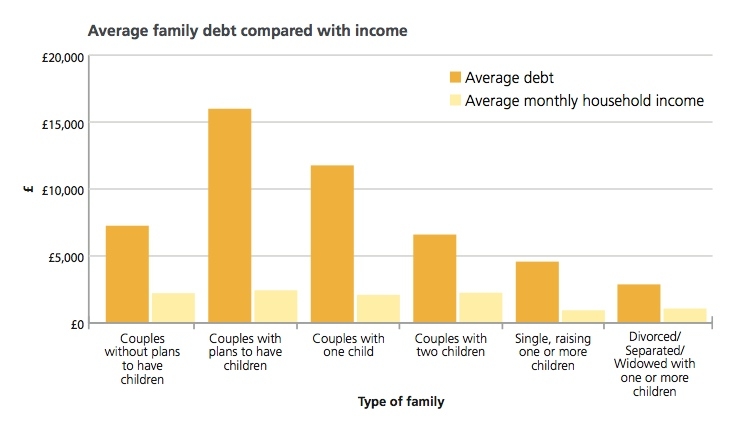

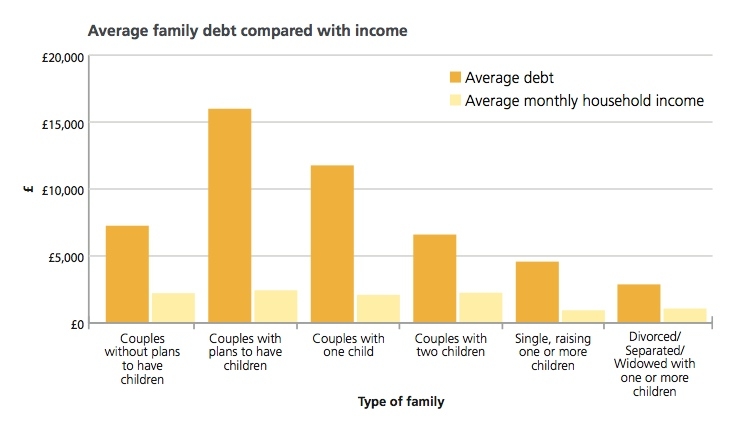

Average family debt up by 48 per cent in the past year

Annual incomes have increased by seven per cent but many people are unemployed or affected by the high rate of inflation.

The results highlight the fact that families are adding to existing debts rather than clearing money owed.

Debt repayment was highlighted as the third biggest expense for families behind housing and food.

The average amount of savings per month was £21 showing the majority of families are trying to build up a savings base but a worrying 42 per cent did not save on a monthly basis and 30 per cent of families admitted they did not have any savings at all.

Louise Colley, head of protection sales and marketing at Aviva, said: "Families in the UK are still very concerned by the rising cost of living and levels of unemployment. While average incomes have increased over the past year, the prices of essential good and services have also increased meaning families are struggling to keep up.

"Many appear to have acclimatised to this economic environment by shopping around and seeking to minimise their spending. However, there are still a worrying number of families with insufficient savings or large debts."