Aviva Investors expands multi asset fund range with two new funds

The introduction of the Aviva Investors Multi-asset Funds I and III brings the Aviva Investors multi asset fund range to five products. The two new funds are intended to be suitable for defensive investors and moderately cautious investors respectively, and will be available from 6 February 2012.

The funds will be managed by Justin Onuekwusi, who has responsibility for the three existing funds (Multi-asset Funds II, IV and V), and will be run in a similar fashion. They are globally unconstrained portfolios which invest across asset classes to meet volatility targets that correspond to levels of investor risk appetite.

A highly flexible and active approach to asset allocation is taken to provide diversification, and the funds sit within the IMA Specialist Sector to avoid prescribed investment constraints. The strategic asset allocation of each fund is reviewed at least quarterly in order to maximise returns against the specified volatility target.

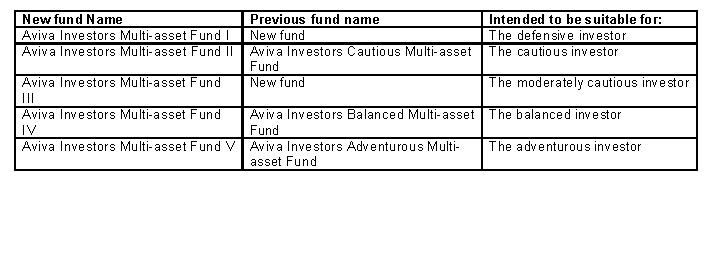

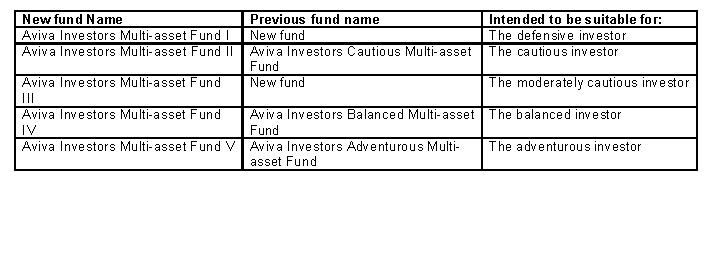

As part of this expansion, Aviva Investors is also re-naming the fund range, moving away from descriptive labels to a numbering convention. The investment objectives and policies of the existing funds remain unchanged.

John Clougherty, chief executive for Aviva Investors UK Fund Services Limited, said: "With the Retail Distribution Review due to be implemented later this year, financial advisers have an ever greater responsibility to consider their clients' attitudes to risk, and to ensure that the products they recommend adhere to appropriate risk parameters. With these two new funds, we can now offer advisers a truly comprehensive multi asset fund range which was designed for the post RDR world and which provides a simple solution for investors whatever their risk profile.

"Our five funds are cost-effective and supported by clear and transparent reporting. They draw on the significant experience and expertise of Aviva Investors' multi-asset and investment teams, who currently manage over £70bn in multi-asset investments, and leverage the full benefits that this scale can provide."

The two new funds will launch as UK OEICs with an AMC of 1.25% for the retail share class and 0.75% for the RDR share class, at which time the full Aviva Investors multi asset fund range is shown in the table.