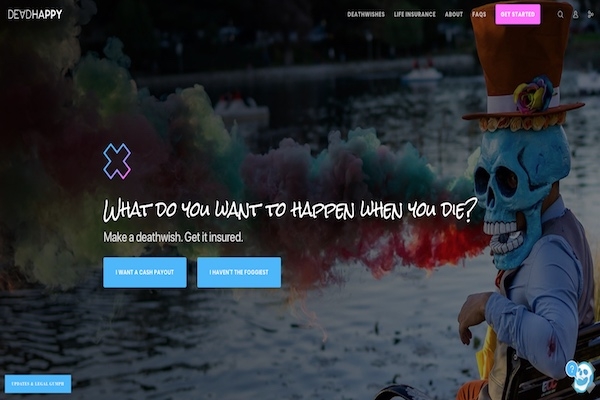

Firm launches pay-as-you-go digital life insurance

Tech start-up firm DeadHappy has launched what it calls the UK’s first fully digital pay-as-you-go life insurance.

The company intends to make it simpler for consumers “to get protection that meets their needs at the right price.”

On average DeadHappy’s life insurance costs £14.78 per month across 10 years, compared to the industry average of £23.25 per month.

The firm says this is because its life insurance is priced annually based on a customer’s current age and risk level – not a prediction about their risk of dying across the next 20 years.

DeadHappy says its applications “take just a few minutes, not hours or days, right through to completion.”

Phil Zeidler, DeadHappy co-founder, said: “Traditional life insurance is overpriced, complex and dull.

“People are paying over the odds as a result.

“Our philosophy is different – you’re far less likely to die when you’re younger, this means you should pay less.

“It’s pretty simple.

“We’re making this possible for the first time in the UK.

“We’re also trying to break new ground in how death is talked about, to help people plan for what happens when they die – without resorting to ‘project fear’.

“Death is never going to be the top of anyone’s list of favourite pub conversations, but we hope to at least make it a more approachable, less daunting conversation to have.”