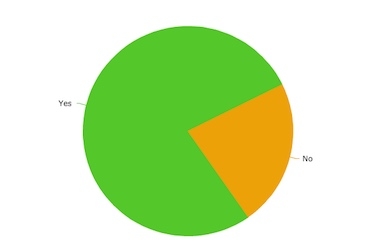

More than one in five readers who have taken part in the FP Today poll say they don’t believe cash flow modelling is essential for true Financial Planning.

Some 22% have so far said no to the question we posed earlier this month.

There is still a day to go before voting closes and you can register your view below.

The vast majority - about 78% - say cash flow modelling is essential for true Financial Planning.

Last week Chartered Financial Planner Martin Bamford explained that despite seeing it as a powerful tool, he doesn’t believe it is essential for true Financial Planning.

Recently, former IFP President Julie Lord, also a Chartered Financial Planner, told Financial Planning Today magazine she tells potential clients to go and see another adviser if they fail to see the value of cashflow modelling.

Mr Bamford said: “I wasn’t surprised to see the poll result as it has been long indoctrinated as a fundamental tool within our profession.

“Cash flow modelling was after all the main pillar of the UK Financial Planning movement when it was formed in the mid-1980s. Yet, we could better serve our clients to think critically when it comes to the important tools we use.

“If we position cash flow modelling correctly and consider shortening the term of projections - or at least present long-term projections based on a range of assumption sets to illustrate the wide variance of outcomes – then it has a role to play in the Financial Planning process. It should not in its unadulterated form as software be considered essential for Financial Planning.”

Ms Lord, who has been using cashflow modelling in business for over 20 years, said: “We don't use it (cashflow modelling) as an add on service but as the foundation on which we base all advice. All clients have a cashflow model, which is updated every year.

“I suspect that those who have found it too complicated, have not taken the necessary time to set up a simple template system that works for their business. It now takes us less than an hour to create an initial model and less than 15 minutes to update it each year.”