Nearly nine out of ten people receiving advice are 40 and over while almost three-quarters of clients are over 50, according to a study by adviser fintech Intelliflo.

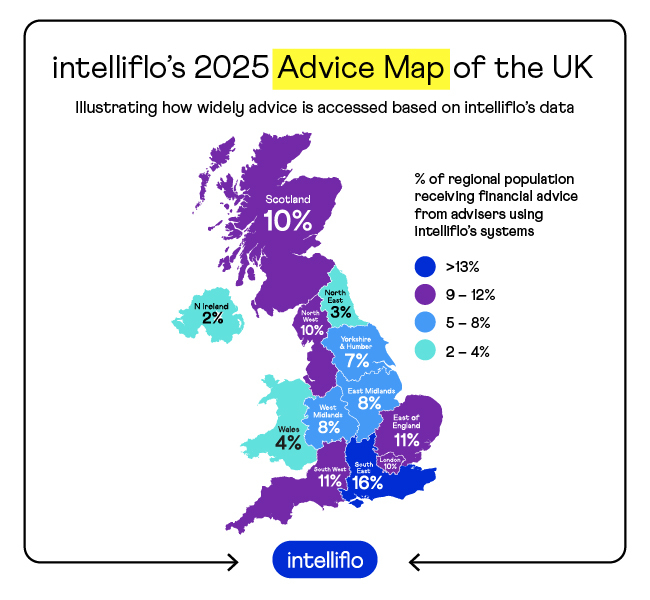

Its latest Advice Map of the UK revealed that married men over 50 living in London or the South East were the most likely to receive financial advice.

The map, which drew on 2.8m advised client records, showed that financial advice remains dominated by older generations, with those over 40 making up 88% of advised clients.

Those over 50 accounted for 73% of advised clients.

Younger people, despite facing increasingly complex financial decisions, remain significantly underrepresented, with just 5% of advice-seekers under the age of 30.

Even among those in their 40s, demand is low at 13%, reinforcing a persistent generational divide in Financial Planning the firm said.

Intelliflo’s data revealed that men were more likely to seek professional financial advice, with 51% of men doing so compared to only 43% of women.

Northern Ireland saw the greatest divide, with 56% of males receiving financial advice, compared to just 44% females. North East followed closely behind with a 11% gap.

Married couples were far more likely to take advice, with 66% of advised clients being married. In contrast, only 17% of single people and 11% of widowers seek financial guidance.

While London (10%) and the South East (16%) saw the highest uptake of financial advice, areas such as the North East (3%), Wales (4%) and Yorkshire (7%) showed much lower levels. Northern Ireland was the least advised region, with just 2% of the population receiving advice.

Nick Eatock, CEO of Intelliflo, said: “Our 2025 Advice Map highlights how urgent it is to address the growing advice gap. Right now, financial advice is mostly reaching older generations, but we need to be more innovative and find ways to connect with younger people, women, and individuals across the whole country.

• Methodology: All data is taken from what financial adviser customers have entered in Intelliflo office and captures UK advised clients that have actively paid or have a valuation in place for professional advice in the last 24 months. As of November 2024 2.82 million UK advised client records are held within Intelliflo office