A financial adviser who launched his own robo-advice business last year says he has no worries that the FAMR report might help potential rivals more than his own firm and believes it will have a beneficial knock on effect.

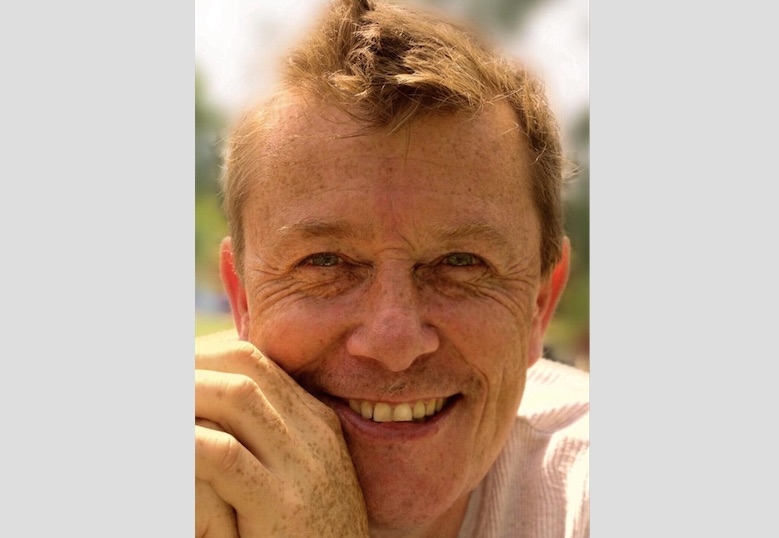

Alastair Rush DipFA MIFS, managing director of Echelon Wealthcare, based in Rutland in the Midlands, has backed the review to help his new online firm, called fiver a day, to thrive.

The FAMR panel told the FCA that they should aid companies that are developing robo-advice services to enable them to be ready for consumers more quickly.

Technology must play an important role in addressing the problems of consumers accessing financial advice, the panel said in its publication.

Asked who the report will help more - himself or potential rivals - Mr Rush said: “I'm never going to present a worry for the big players, I'm happy growing slowly and steadily.

“One of my big worries about a robo model was that I used the tech to scale up, too quickly, in an uncertain regulatory environment. It's deceptively easy to do, I'm picking my way carefully.

“So, no, I'm not worried at all. If anything, the major players will raise the sector profile, thereby making my existence more natural to new customers. I then, stand on my own merits (a quality service - one more for a free range customer, not one who wants to be a battery investor).

“So, it'll help us all in many ways - a rising tide raises all vessels - even little dinghies like me.”

The FAMR report said technology can help create “a more engaging, cost-effective advice market”.

Mr Rush believes the report does go far enough in its focus on technology for the time being.

He said: “I'd rather manageable baby steps than big leaps which may have to be unpicked. It's understandable that this could be done quicker, but from the client’s perspective, not ours, we have to tread cautiously and carefully.

“I can't see Tracey McDermott wanting to hand her successor a fait accompli that doesn't present wriggle room.”

Do you broadly agree with the recommendations of the #FAMR report?https://t.co/E26oRyVIJy

— FP Today (@FPTodayNews) March 14, 2016

Financial Planner Keith Churchouse CFPTM Chartered MCSI launched his own robo-adviser, SaidSo just over a year ago.

He welcomed the FAMR report and said: “I and the team at SaidSo.co.uk are pleased to see that the Innovation Hub of the FCA is deemed to be a success and should continue apace, with more support for firms going forward.

“Technology and financial technology are vital and will grow into ever more important in the delivery of UK retail financial advice. It is good to see this recognised and additional guidance is welcome to deliver great outcomes to the end consumer. It is clear they welcome innovation.

“I am also pleased to see the comments on the challenge to industry to introduce a Pensions Dashboard which would/should naturally be technology based. The suggestion of a portable fact find is interesting and it would be good to see if the two concepts could be merged into one user friendly ‘financial centre’ base for the user.”