Thursday, 28 June 2012 13:08

Advisers favour Standard Life and Sippcentre as Sipp providers - poll

A survey of 1,000 financial advisers has found that Sipps provided by specialist providers are, on average, more popular than Sipps provided by life and pension companies.

Some 55 per cent of advisers said they dealt with two or more Sipp providers, usually one who dealt with a simple Sipp and one who managed commercial property investments.

Although life and pension providers allow commercial property within a Sipp, the majority of advisers preferred to use a specialist Sipp company.

Advisers said they valued the tax expertise, property knowledge and smooth administration of specialist firms.

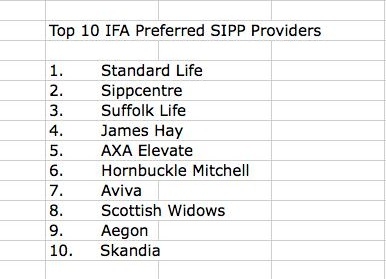

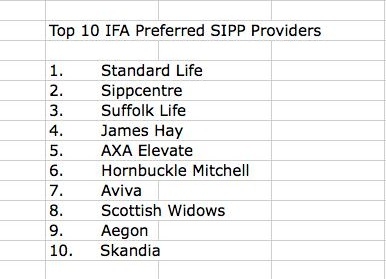

The survey by Splice Consulting found the top preferred Sipp provider was Standard Life followed by Sippcentre, part of AJ Bell, and Suffolk Life.

The Standard Life Sipp was rated highly for its competitive pricing, wide range of funds, no initial fund fees and knowledgeable staff.

Sippcentre, a specialist provider, was voted second for 'cheap and cheerful service', low pricing structure and simple online tools.

An analysis of client bases found that Sippcentre clients had on average 42 per cent greater assets than Standard Life clients.

Julian Green, managing director at Splice Consulting, said: "This indicates AJ Bell's strategy of extending its proposition downmarket, through Sippcentre, is bearing dividends faster than the life and pension providers moving upmarket.

"Generalist Sipp providers face an uphill battle in convincing IFAs to direct their wealthiest clients to their Sipp propositions, without material investment in specialist administrative support and experience."

• Financial Planner's next issue, published in July, will include a full Sipp Survey looking at how providers are preparing for the RDR changes plus extensive tables.

Some 55 per cent of advisers said they dealt with two or more Sipp providers, usually one who dealt with a simple Sipp and one who managed commercial property investments.

Although life and pension providers allow commercial property within a Sipp, the majority of advisers preferred to use a specialist Sipp company.

Advisers said they valued the tax expertise, property knowledge and smooth administration of specialist firms.

The survey by Splice Consulting found the top preferred Sipp provider was Standard Life followed by Sippcentre, part of AJ Bell, and Suffolk Life.

The Standard Life Sipp was rated highly for its competitive pricing, wide range of funds, no initial fund fees and knowledgeable staff.

Sippcentre, a specialist provider, was voted second for 'cheap and cheerful service', low pricing structure and simple online tools.

An analysis of client bases found that Sippcentre clients had on average 42 per cent greater assets than Standard Life clients.

Julian Green, managing director at Splice Consulting, said: "This indicates AJ Bell's strategy of extending its proposition downmarket, through Sippcentre, is bearing dividends faster than the life and pension providers moving upmarket.

"Generalist Sipp providers face an uphill battle in convincing IFAs to direct their wealthiest clients to their Sipp propositions, without material investment in specialist administrative support and experience."

• Financial Planner's next issue, published in July, will include a full Sipp Survey looking at how providers are preparing for the RDR changes plus extensive tables.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

This page is available to subscribers. Click here to sign in or get access.