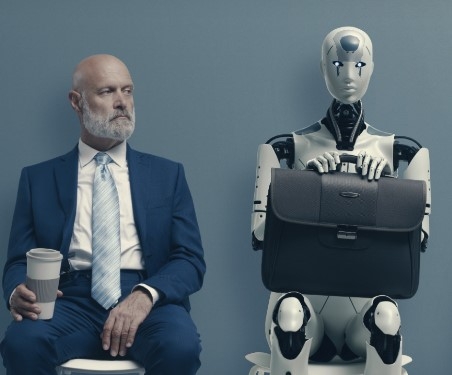

While there may be challenges to deal with down the line, a new report for Financial Planning Today Magazine found that at present, most Planners do not feel threatened by AI.

However, that does not mean a shift to AI technologies does not mean risks.

Nath Papadacis, chief technology offer at Liberate Wealth, said AI can be a benefit for Financial Planning firms depending how it is used but could also present a long term competitive risk.

He said that AI can very useful to Financial Planners for tasks such as client reviews and summarising meetings to free up time for the adviser.

One firm currently using AI tools is wealth manager St James’s Place. In September the firm upgraded its financial crime defences with an AI solution which enables large-scale, ongoing customer screening and re-screening for financial crime compliance.

The FCA was worried enough last year about AI to commission a report with the Bank of England and Prudential Regulation Authority on the use of AI in financial services. The initial feedback report highlighted some salient pointers for Financial Planners.

To read the full report, turn to the latest issue of Financial Planning Today Magazine.

• This article is from the latest edition of Financial Planning Today Magazine. The latest Financial Planning Magazine will be free to read online until the end of this week at https://bit.ly/2ZdVXWz