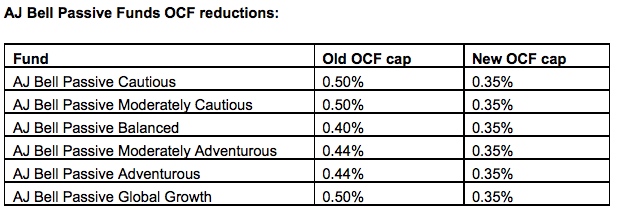

The annual charges on AJ Bell’s range of six passive multi-asset funds have been cut to 0.35%.

The firm says the reduction is part of AJ Bell’s commitment to lowering costs for investors as its funds grow in size.

The AJ Bell passive funds were launched in March 2017 with an Ongoing Charges Figure (OCF) capped at 0.5%.

Within this, AJ Bell’s Annual Management Charge is fixed at 0.15%, meaning that any cost savings that AJ Bell can realise have been automatically passed back to customers in the form of a lower OCF.

The AJ Bell Balanced fund is the largest in the range and has already seen two price cuts, taking its OCF down to 0.40%. The next two largest funds by assets, Adventurous and Moderately Adventurous, also saw their OCFs fall from 0.5% to 0.44% in January.

The firm has now decided to reduce the OCF cap on all the funds to 0.35% in a move it says will keep the range “simple and easy for people to understand.”

AJ Bell’s management charge within the OCF remains fixed at 0.15% and so any further cost savings it can achieve, either through efficiencies of scale or negotiating down underlying fund charges, will continue to automatically benefit customers.

Kevin Doran, chief investment officer at AJ Bell, said: “When we launched our funds almost two years ago we put a cap on the OCF so that customers knew in advance the most they were likely to pay.

“We also made a commitment to reducing the OCF over time as the funds grew in size.

“We’ve kept that promise through a series of reductions to the OCFs on three of the funds and are now in a position to apply further reductions to the entire range.”

He added: “With the OCF now capped at 0.35%, the funds stand toe-to-toe with the cheapest multi-asset funds in the market.

“Offering true multi-asset exposure and an unfettered approach to investment selection, we make the same low price available to all investors, regardless of which platform they use and irrespective of whether they’re advised or not.

“We just think it’s about time investment was made easy.”