Armed forces adviser launches new robo-advice site

A financial adviser whose firm specialises in serving military clients is set to launch his own robo-advice business this month and says he is not afraid of competition from the big boys.

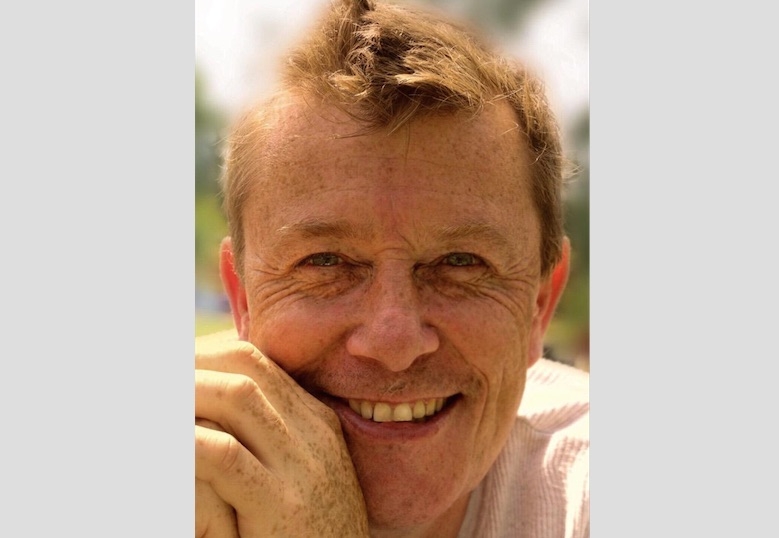

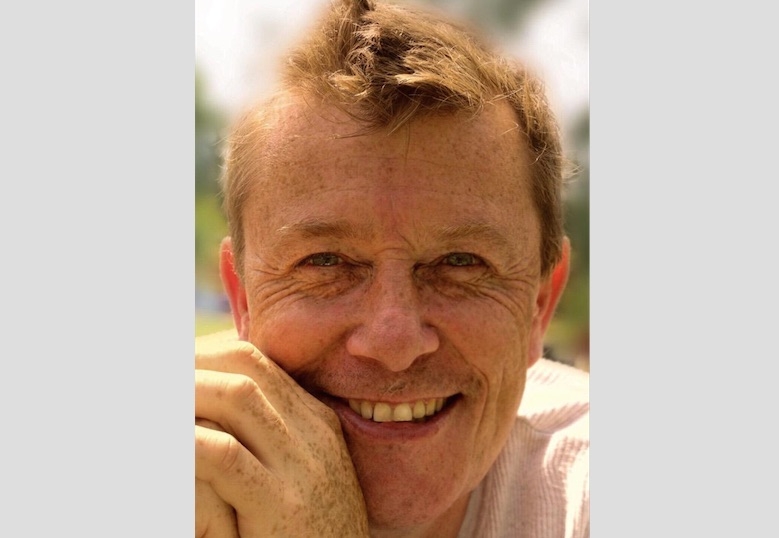

Alastair Rush, managing director of Echelon Wealthcare, based in Rutland in the Midlands, has created fiver a day, described as being “for people seeking effective and low cost investment management”.

He said: “I want the brand to reflect the values associated with eating your five a day, i.e healthily, but of course, with financial overtones.

“I want it to stand for healthy investing whereby I use tech to allow clients with basic needs to have access to some quite sexy functionality, advice and fund management for far less than my competition will be offering.

“I genuinely want to change things in financial services for the better. For too long we have had to justify daft costs or exclude clients because they are not wealthy enough to warrant high costs.

“This is going to be a volume strategy for clients who have simple needs or for wealthier clients who are fed up with paying too much for a shabby service. It is not going to be a yield one.”

Mr Rush, who entered into financial services about ten years ago, after a career with the RAF, has been considering setting up an automated advice service for 4 to 5 years.

{desktop}{/desktop}{mobile}{/mobile}

A company like Nutmeg might be seen as a loose competitor, he said. Asked if he had reservations about going up against much bigger businesses which are already offering online and automated advice, he said: “I’m a lot more agile than them, I don’t have the financial demands on me that they have and I can respond to the various odds and ends more quickly than they can.

“I love competition and what have I got to lose? It’s invigorating, it’s nice to have something new to get your teeth stuck into and to be at the forefront.”

He believes there has always been a gap in the advice market but it is now possible to articulate this more effectively and technology is allowing better solutions.

So called robo-advisers have been frowned upon by some, so why does Mr Rush think there has been a frosty reception?

He suggested there was an element of insecurity and said: “I think it’s fear of the unknown and I understand that, if you’ve had sleepless nights for years, working hard getting to chartered status then the last thing you want is someone flogging cheap advice.

“I think some are sniffy about it but I don’t think they need to be, it doesn’t threaten, it complements their service.”

He believes advisers needed to move with the times, saying: “You can not put the genie back in the bottle, it has escaped. I think we have to embrace it, the tail does not wag the dog, if we listen to the people out there they’re saying they don’t want what we’re offering (traditionally).”

He said an online or automated offering can “increase appeal to your flock and audience” but added for older advisers approaching the end of their career there was no incentive to go down that route and move away from a traditional advisory practice.

IFP chief executive Steve Gazzard believes robo-advice could prove beneficial by helping to better define true Financial Planning, while Life Planning founder George Kinder, who has launched his own web-based service, said there were tremendous benefits.

Mr Rush’s new service offers a restricted basket of funds. His website states that it does not offer a “holistic assessment of your financial situation or take into account any existing investments that you may hold”. Neither can someone apply for a regulated pension product.

He expects the service, powered by Parmenion, to launch in two to three weeks.