Average earnings rose 5.6% for the three months from February to April 2021 according to the latest labour market report from the Office for National Statistics (ONS).

The annual growth is 4.4% after inflation.

Pay growth is driven by compositional effects of a fall in the number and proportion of lower-paid employee jobs and because the latest month is now compared with spring/summer 2020 when earnings were first affected by the Coronavirus pandemic.

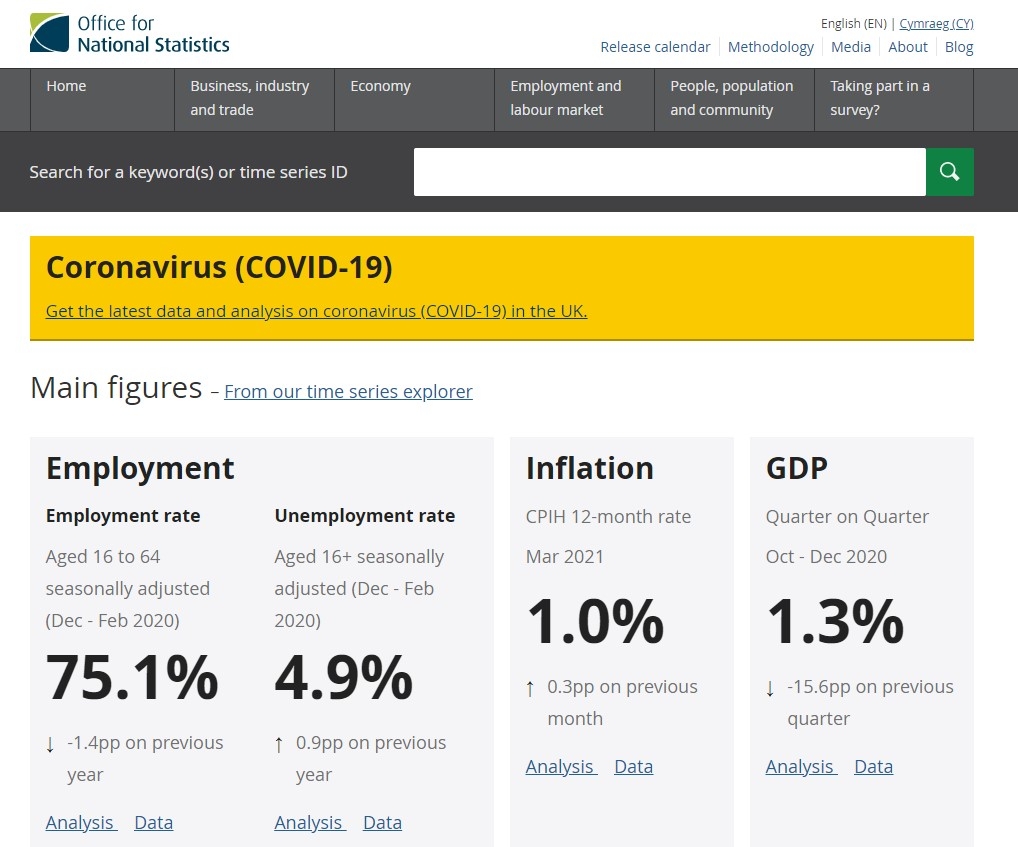

Unemployment fell to 4.7% in February to April with redundancies falling at a record rate to reach pre-pandemic levels.

The data shows a sustained risk in employment levels, with a sixth consecutive month of increasing payrolled employees.

Vacancies are also now above pre-pandemic levels in most industries.

Sarah Coles, personal finance analyst at Hargreaves Lansdown, said the jump in average pay is set to be the start of a run of bumper annual wage rise figures which could put the State Pension triple lock under pressure.

She said: "April’s jump in average pay is set to be the start of a run of bumper annual wage rise figures. These are due to feed into next year’s state pensions triple lock, which would give State Pensioners a huge pay rise at a time when the working population will likely be still clawing their way back from the economic effects of the crisis. At a time when the government is watching every penny, a double-digit rise in the state pension could call the triple lock itself into question."

Paul Craig, portfolio manager at Quilter Investors said the latest data should help ease concerns that the UK will experience widespread job losses this year. However, he wanted that with the lockdown easing plan delayed without an extension to the furlough scheme, this could have consequences and is the first time the scheme and lockdown easing plan have been “disjoined” since the start of the pandemic.

He said: “Companies face the prospect of increased costs in July even though many will not legally be able to reopen or trade fully. Employers will need to start contributing 10% towards furlough costs as well as a proportion of their business rates. It may be prudent to 'ease off the accelerator' as Boris Johnson stated given the increase in infection rates, but companies will be disappointed that despite the lockdown extension Boris also rebuffed calls for extra financial support.”

Laith Khalaf, financial analyst at investment platform AJ Bell, said that whilst all the dials in the labour market are pointing in a positive direction, they are heavily distorted by the furlough scheme and the pandemic still have the capacity to derail the labour market.

He said: “Unemployment is heading in the right direction, but we are still missing around half a million jobs compared to February of last year, not counting the uncertain future of those on furlough. This highlights the economic damage the pandemic has wrought and in all the progress we have made, it’s important to recognise that the reopening of the economy naturally brings with it an element of growth from a very low base. The latest figures from the labour market are certainly positive, but it’s probably best to keep the champagne on ice for now.”