Cautious Managed funds remained the top-selling sector in December accounting for 48 per cent of net sales, according to Cofunds.

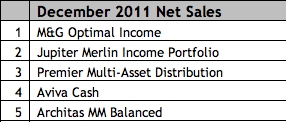

Three of the top five funds were in the Cautious Managed sector, the Jupiter Merlin Income Portfolio, the Architas MM Balanced and Premier Multi-Asset Distribution funds.

The highest-selling fund on the platform overall was the M&G Optical Income fund, a Strategic Bond fund managed by Richard Woolbough.

This has always been a popular fund for Cofunds but this was the first time it had reached the top spot.

The Strategic Bond sector as a whole accounted for 14 per cent of net sales, compared to a monthly average of 11 per cent.

Michelle Woodburn, manager of fund group relations at Cofunds, said: “Money Market funds jumped considerably in December, with nine per cent of net sales. Within this sector Aviva Cash attracted most adviser interest and featured in the top five fund by retail net sales overall.”

However, the signs were less positive for the equity sector which saw net outflows.

“Equity sales did not finish the year strongly. Europe, UK All Companies, UK Equity Income, Specialist and UK Smaller Companies were all in net outflow. While the UK All Companies and UK Equity Income sectors both brought in reasonable levels of new business, their net position was dragged down last month by high redemptions.”