Chartered Planner calls on FCA to review risk definition

A leading Chartered Financial Planner has called on the Financial Conduct Authority (FCA) to redefine risk classifications to reflect current conditions.

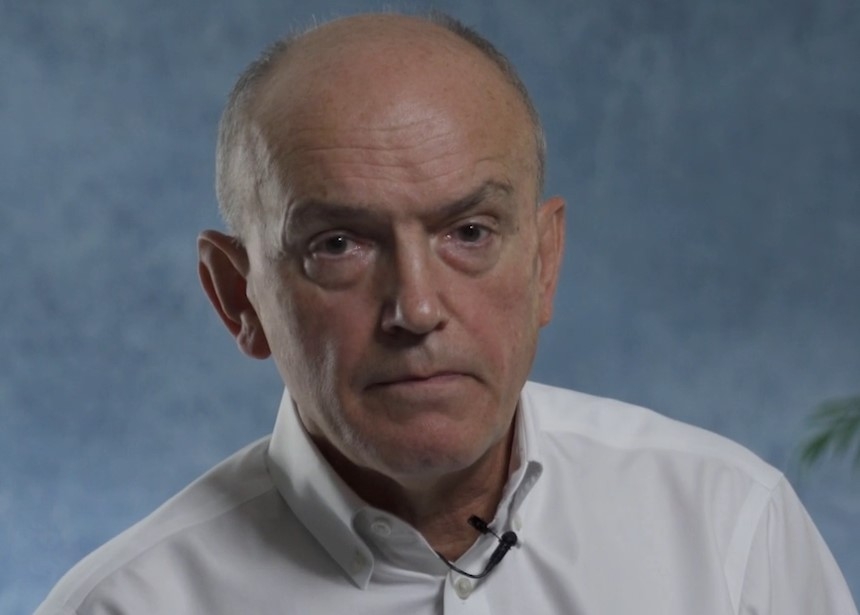

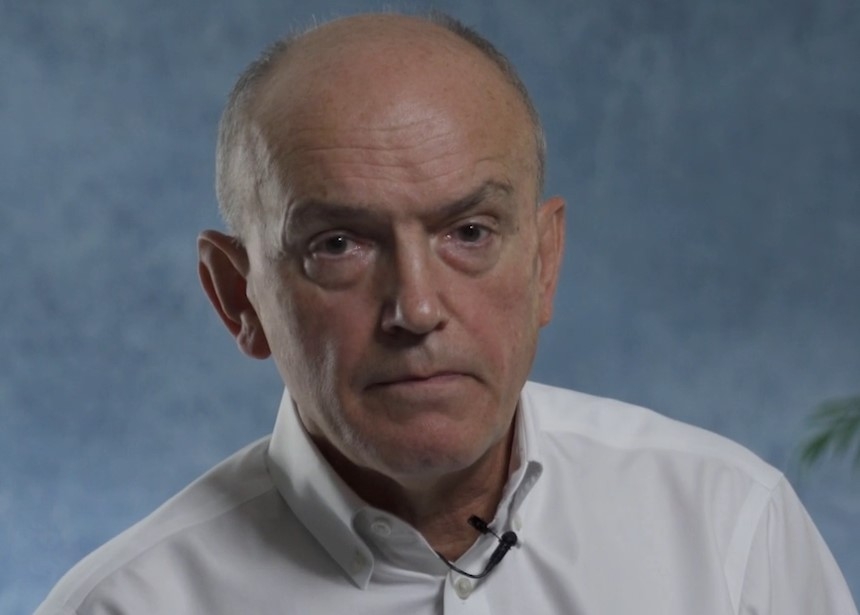

Doug Brodie, chief executive of Financial Planning firm Chancery Lane, has written to the regulator urging it to amend its rulebook to differentiate between its definitions of income risk and capital risk.

His letter to the regulator was sent as the firm released a white paper carrying out an analysis of investment strategies often used in retirement planning. The report questions common assumptions around risk and whether they are appropriate for the current low interest economy.

Mr Brodie said the “obsession” with total return is misleading and has also called for the fund management industry to move to risk definitions that demonstrate income risk and capital risk separately.

He said asset managers are “doing investors a disservice” with currently total return risk definitions as capital volatility of long-term assets masks the stability found through steady dividend streams.

Mr Bodie said the common assumption that high levels of equity exposure are unsuitable for pensioners is essentially flawed.

He said: “There is no correlation between equity market risk to capital and stability of dividends. We need to stop just communicating total return payments and show Joe Public what the income will look like.

“Telling an 80-year-old, who doesn’t work, that they have to sit in fixed income and suffer the consequences of low-yielding assets is both illogical and unhelpful when there are other solutions.

“The whole industry can help itself by displaying the different elements or ingredients that make up the cake of a total return. If as a collective we carry on hiding income reliability behind the capital volatility, it's partly our own fault and no wonder that the regulator still regards everything being under the one risk banner.”

The white paper from Chancery Lane analysed 31 mainstream investment trusts over the period since 1974, one of the most volatile periods in the equity and bond markets since 1929. A dividend payment was never missed by any trust, the payment was the same or higher than the prior year in 97% of cases and in 89% of cases it was increased in every year.

Mr Bodie says this strengthens the argument that the simplicity of the natural income approach is more predictable, and ultimately more reassuring for investors. He said it meets what is required by most pension drawdown investors i.e. an income for life, rising each year to counter inflation, with a good degree of certainty.

He said: “The one-time backbone of a retirement plan and our ‘hero’ approach is the humble investment trust, with its ability to support dividend payment and balance sheet reserves which offer stable income to those who have waved farewell to their monthly salary. It may not be sexy, but it is definitely the ‘reliable boyfriend.”

Chancery Lane is a Financial Planning firm launched in July focusing solely on retirement income planning. The firm services baby boomers with pension pots of £250,000 plus and specialises in offering natural income.

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/