Mixed Investment 20-60 per cent shares was the highest selling sector on the Cofunds platform in the fourth quarter of 2012.

This sector accounted for 104 per cent of net sales.

In second place was the Sterling Strategic Bond sector which accounted for 42.9 per cent of net sales. This was due to the M&G Optimal Income, Invesco Perpetual Monthly Income Plus and Fidelity Strategic Bond all being placed in the top 20 at fifth, twelfth and thirteenth place respectively.

The Global Equity Income sector counted for 21.7 per cent while Global Emerging Markets sector accounted for 10.6 per cent.

{desktop}{/desktop}{mobile}{/mobile}

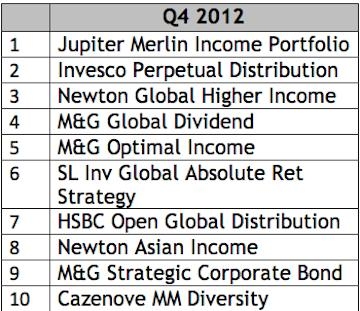

The highest selling individual fund was Jupiter Merlin Income Portfolio which is worth £4.1bn and managed by John Chatfeild-Roberts.

It was followed by Invesco Perpetual Distribution and Newton Global Higher Income in second and third place. The most popular company was M&G, a corporate member of the Institute of Financial Planning, which had three funds, M&G Global Dividend, M&G Optimal Income and M&G Strategic Corporate Bond, in the top 10.

Michelle Woodburn, head of fund group relations at Cofunds, said: "The Mixed Investment 20-60 per cent sector remains popular with advisers. However, it is not as concentrated as it was earlier in 2012. Bonds are also still in favour over equities, with UK, Global, Euro and Specialist Equity funds seeing the highest outflows whilst Strategic Bonds fund have seen high inflows."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.