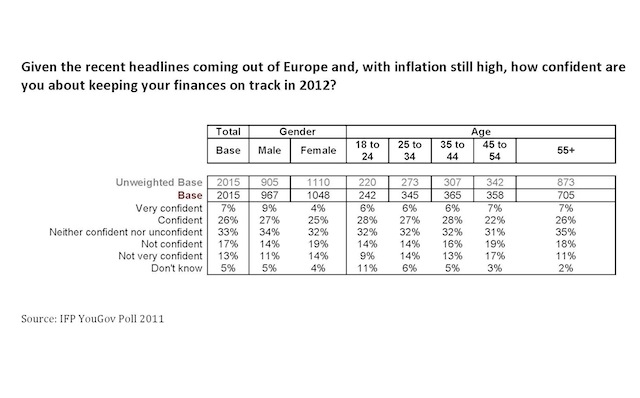

Just one in three people (33%) are confident that they will be able to keep their finances and plans on track in 2012 as a result of the Eurozone crisis and pressure they are feeling on their budget as a result of inflation. That's according to the final YouGov poll* carried out in association with NS&I (National Savings and Investments) for Financial Planning Week (21-27 November), which is run by the Institute of Financial Planning (IFP).

The Institute of Financial Planning (IFP) has been carrying out a series of daily polls with consumers throughout Financial Planning Week to find out what people are thinking when it comes to their money – and how they are coping with their personal finances during these uncertain times.

Today's poll reveals that many are uncertain about what 2012 may hold for them and their finances. As Financial Planning Week draws to a close, IFP stresses the importance of thinking ahead and making financial plans so that people are better prepared for whatever situation they might face next year. To help, this week the IFP has launched its first ever bulletin for consumers. Its quarterly E-bulletin "Your Money, Your Life" aims to provide ideas and tips to help people make more effective Financial Plans. Consumers can sign up to receive the free newsletter here - www.financialplanningweek.org.uk.

Nick Cann, CEO of IFP, said: "Today's result proves how difficult it is for people to predict what might happen with the economy, and their own household finances, next year. Strong leadership is required to take bold decisions to improve the position with the Eurozone. For people in Britain who are feeling the pinch when it comes to the family budget, underpinning this uncertainty is the need to have a Financial Plan to work through the next few years of economic uncertainty. Whilst much can be done by individuals themselves, for many there will be no substitute to working with a professional Financial Planner to navigate these choppy waters"

Marlene Shalton FIFP, CFPCM, President of IFP and Financial Planner with Bluefin Wealth Management, said: "People do seem to be uncertain about what lies ahead in 2012, which is not surprising given the current economic climate and the difficulties facing a number of European countries. People can obtain greater reassurance about their own financial situation if they think ahead and create a financial plan that they can adapt and follow when times are unclear. Having such a financial plan in place can bring more certainty to people's lives and greater peace of mind too."

John Prout, Retail Customer Director at NS&I, said: "Given continuing uncertainty in the Eurozone and modest economic growth at home, it is unsurprising that many people are not sure whether they will be able to keep their finances on track in 2012. When money is tight, it is all the more important to think ahead about finances in order to keep wider plans for the future on track."

Martin Palmer, head of corporate benefits marketing at Friends Life, said: "The fact that a third of those surveyed are confident they can keep their finances on track despite the current economic climate is encouraging. This would suggest that people are actively managing their money and planning for all economic eventualities. Hopefully this is a trend we will see continue."