Thursday, 20 September 2012 09:54

Contributions to DC schemes increase but membership remains flat

The amount of money being saved into defined contribution (DC) pension schemes has increased, according to the Office for National Statistics.

In 2011, contributions were 6.6 per cent for employers, up by 0.4 per cent, and 2.8 per cent for members, a rise of 0.1 per cent from 2010.

However, the contribution rate for those in defined benefit pension schemes had decreased from 15.8 per cent to 14.2 per cent for employers and from 5.1 per cent to 4.9 per cent for members.

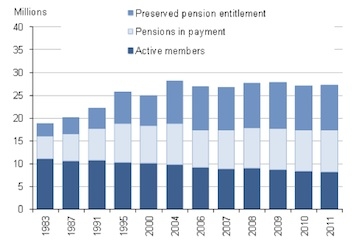

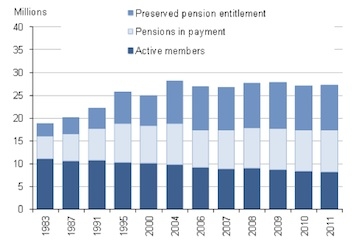

Total membership of occupational pension schemes was 27.2m, unchanged from 2010. This was broken down into 13m in public sector schemes and 14.2m in private sector schemes.

Jamie Jenkins, head of workplace strategy at Standard Life, said: "Active membership of workplace pension schemes has been falling for several years and we had no reason to expect this trend to change.

"However, it is encouraging that the latest ONS figures show that those who are actively saving into a defined contribution workplace pension are now saving more than last year and their employers are contributing more too."

He said he hoped auto-enrolment, which begins for the largest firms in October, would reverse the downward trend in membership.

"Auto-enrolment is a huge opportunity to reverse the downward trend in active membership and help more people to save so they can be financially secure in their later years and afford to retire."

In 2011, contributions were 6.6 per cent for employers, up by 0.4 per cent, and 2.8 per cent for members, a rise of 0.1 per cent from 2010.

However, the contribution rate for those in defined benefit pension schemes had decreased from 15.8 per cent to 14.2 per cent for employers and from 5.1 per cent to 4.9 per cent for members.

Total membership of occupational pension schemes was 27.2m, unchanged from 2010. This was broken down into 13m in public sector schemes and 14.2m in private sector schemes.

Jamie Jenkins, head of workplace strategy at Standard Life, said: "Active membership of workplace pension schemes has been falling for several years and we had no reason to expect this trend to change.

"However, it is encouraging that the latest ONS figures show that those who are actively saving into a defined contribution workplace pension are now saving more than last year and their employers are contributing more too."

He said he hoped auto-enrolment, which begins for the largest firms in October, would reverse the downward trend in membership.

"Auto-enrolment is a huge opportunity to reverse the downward trend in active membership and help more people to save so they can be financially secure in their later years and afford to retire."

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

This page is available to subscribers. Click here to sign in or get access.