Thursday, 24 January 2013 12:25

Cost of raising a family with five kids to age 21 tops £1m

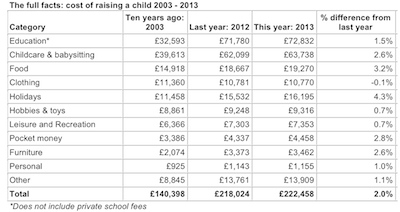

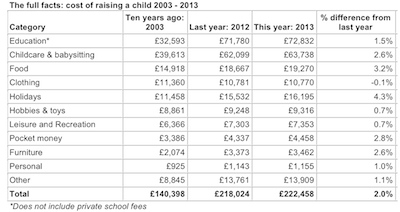

The cost of raising a child to age 21 has risen by £4,000 in the past year to reach an all-time high of £222,358, according to a survey. A family with 5 children would face costs of over £1m in raising their children to age 21. A family with two children would need to find over £440,000 to pay for their children to the same age (see Table 1).

The Cost of a Child Report [1] says that the cost is £82,000 (58%) more than ten years ago when the first annual Cost of a Child Report from protection specialist LV= was published. To fund the increase parents are saving less and cancelling insurance policies or cutting back on protection cover.

The biggest elements of expenditure for parents remain education and childcare. The cost of education excluding private school fees (including uniforms, after school clubs and university costs) has risen from £32,593 to £72,832 per child in the last 10 years - a 124% increase. Childcare costs have also rocketed from £39,613 in 2003 to £63,738 today - a 61% increase.

From birth to 21, parents spend an average of £19,270 on food and £16,195 on holidays - which now cost 4% more than last year. In the last decade, costs have risen in all areas of expenditure apart from clothing, which has seen a 5% drop.

According to the report, parents are having to tighten their purse strings, with more than three quarters (76%) forced to make cutbacks to make ends meet. While many are reining in spending on luxuries such as holidays (45%), more than a quarter are also cutting back how much they spend on essentials such as food (27%).

Of those parents who are cutting back, 68% have switched to buying cheaper or value goods. Vouchers and discount codes are also popular, with 56% of these parents using them to save on shopping bills. Many are also trying to boost their income, with 40% by selling personal items on online or at car boot sales.

Mark Jones, LV= head of protection, said: "The cost of raising a child continues to soar and is now at a ten year high. Everyone wants the best for their children, but the rising cost of living is pushing parent's finances to the limit. There seems to be no sign of this trend reversing.

"If the costs associated with bringing up children continue to rise at the same pace, parents could face a bill of over £350,000 in ten years time[2]."

Over the last ten years, London (£239,123), the South East (£237,233) and the East of England (£233,363) have remained the three most expensive places to raise children. Ten years ago this was closely followed by Wales, whereas now it is Northern Ireland (£232,883). Families in the South West have seen the biggest increase in costs, now paying £100,077 more per child than they were ten years ago (see table below).

Part of the increase in cost is the increase in expectation among children, says LV=. Today's children want the same toys as their parents, and the popularity of smartphones, tablets and laptops is adding to the expense of raising a child.

{desktop}{/desktop}{mobile}{/mobile}

Almost a third (27%) of parents have bought their child an electronic gadget in the last 12 months, with almost a fifth (16%) forking out for a laptop or iPad/tablet. The average yearly amount parents spend on these gadgets for their child is £302.

Many cash-strapped families are responding to financial pressures by saving less and spending less. Two-fifths (40%) of parents have cut the amount they are stashing in savings accounts and a further 26% of those who are cutting back (up from 22% last year) have cancelled or reviewed insurance policies to try to save money.

Almost half (47%) of parents have no life cover, income protection or critical illness cover in place. While 36% of parents do have life cover, only 11% have critical illness cover and only 6% have income protection.

The Cost of a Child Report [1] says that the cost is £82,000 (58%) more than ten years ago when the first annual Cost of a Child Report from protection specialist LV= was published. To fund the increase parents are saving less and cancelling insurance policies or cutting back on protection cover.

The biggest elements of expenditure for parents remain education and childcare. The cost of education excluding private school fees (including uniforms, after school clubs and university costs) has risen from £32,593 to £72,832 per child in the last 10 years - a 124% increase. Childcare costs have also rocketed from £39,613 in 2003 to £63,738 today - a 61% increase.

From birth to 21, parents spend an average of £19,270 on food and £16,195 on holidays - which now cost 4% more than last year. In the last decade, costs have risen in all areas of expenditure apart from clothing, which has seen a 5% drop.

According to the report, parents are having to tighten their purse strings, with more than three quarters (76%) forced to make cutbacks to make ends meet. While many are reining in spending on luxuries such as holidays (45%), more than a quarter are also cutting back how much they spend on essentials such as food (27%).

Of those parents who are cutting back, 68% have switched to buying cheaper or value goods. Vouchers and discount codes are also popular, with 56% of these parents using them to save on shopping bills. Many are also trying to boost their income, with 40% by selling personal items on online or at car boot sales.

Mark Jones, LV= head of protection, said: "The cost of raising a child continues to soar and is now at a ten year high. Everyone wants the best for their children, but the rising cost of living is pushing parent's finances to the limit. There seems to be no sign of this trend reversing.

"If the costs associated with bringing up children continue to rise at the same pace, parents could face a bill of over £350,000 in ten years time[2]."

Over the last ten years, London (£239,123), the South East (£237,233) and the East of England (£233,363) have remained the three most expensive places to raise children. Ten years ago this was closely followed by Wales, whereas now it is Northern Ireland (£232,883). Families in the South West have seen the biggest increase in costs, now paying £100,077 more per child than they were ten years ago (see table below).

Part of the increase in cost is the increase in expectation among children, says LV=. Today's children want the same toys as their parents, and the popularity of smartphones, tablets and laptops is adding to the expense of raising a child.

{desktop}{/desktop}{mobile}{/mobile}

Almost a third (27%) of parents have bought their child an electronic gadget in the last 12 months, with almost a fifth (16%) forking out for a laptop or iPad/tablet. The average yearly amount parents spend on these gadgets for their child is £302.

Many cash-strapped families are responding to financial pressures by saving less and spending less. Two-fifths (40%) of parents have cut the amount they are stashing in savings accounts and a further 26% of those who are cutting back (up from 22% last year) have cancelled or reviewed insurance policies to try to save money.

Almost half (47%) of parents have no life cover, income protection or critical illness cover in place. While 36% of parents do have life cover, only 11% have critical illness cover and only 6% have income protection.

This page is available to subscribers. Click here to sign in or get access.