Tuesday, 18 September 2012 09:43

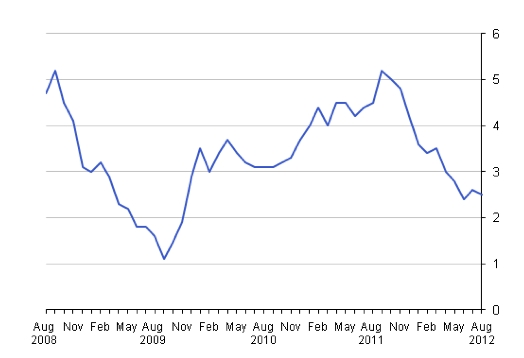

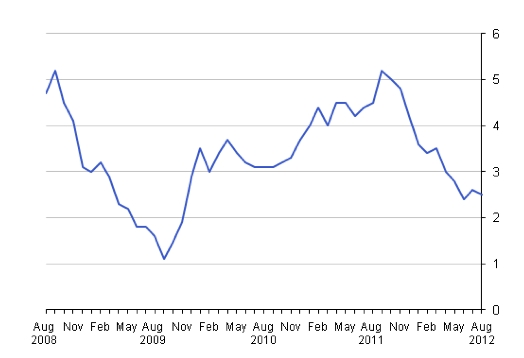

CPI inflation falls to 2.5 per cent in August

Consumer Prices Index (CPI) inflation has fallen to 2.5 per cent in August, down from 2.6 per cent in July, according to the Office for National Statistics.

Retail Price Index (RPI) inflation fell from 3.2 per cent to 2.9 per cent.

This follows a rise in July from 2.4 per cent to 2.6 per cent.

This month's figures will be positive for the Bank of England as it works towards its target of two per cent inflation.

The largest downward pressure came from furniture, household equipment, household services and clothing and footwear. Upward pressures came mainly from transport which rose 1.3 per cent.

For the RPI, which includes mortgage payments, largest downward pressures came from household goods, clothing and footwear and food. The only upward pressures came from fares and travel costs.

The CPI rose by 0.5 per cent between July and August 2012 compared with a rise of 0.6 per cent a year ago.

Between August 2011 and August 2012, the CPI rose by 2.5 per cent.

Since April 2011, the CPI is the index used to calculate tax benefits, tax credits and public service pensions.

Retail Price Index (RPI) inflation fell from 3.2 per cent to 2.9 per cent.

This follows a rise in July from 2.4 per cent to 2.6 per cent.

This month's figures will be positive for the Bank of England as it works towards its target of two per cent inflation.

The largest downward pressure came from furniture, household equipment, household services and clothing and footwear. Upward pressures came mainly from transport which rose 1.3 per cent.

For the RPI, which includes mortgage payments, largest downward pressures came from household goods, clothing and footwear and food. The only upward pressures came from fares and travel costs.

The CPI rose by 0.5 per cent between July and August 2012 compared with a rise of 0.6 per cent a year ago.

Between August 2011 and August 2012, the CPI rose by 2.5 per cent.

Since April 2011, the CPI is the index used to calculate tax benefits, tax credits and public service pensions.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

This page is available to subscribers. Click here to sign in or get access.