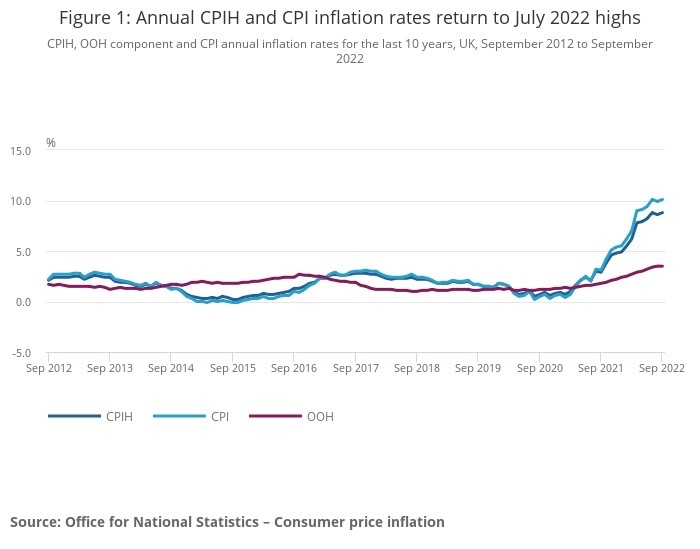

CPI inflation returned to its upward trend in September, hitting 10.1% after a dip in August to 9.9%, according to figures released today by the ONS.

The Consumer Prices Index (CPI) spike back up as food costs soared.

On a monthly basis, CPI rose by 0.5% in September 2022, compared with a rise of 0.3% in September 2021.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 8.8% in the 12 months to September 2022, up from 8.6% in August and returning to July’s recent high.

The ONS said that rising food prices made the biggest upward contribution to changes in both the CPIH and CPI annual inflation rates between August and September 2022.

Apart from food, the major driver of inflation was housing and household services costs (mainly electricity, gas and other fuels and owner occupiers' housing costs.)

The biggest downward pressure was the fall in the cost of motor fuel such as petrol. Rising petrol prices were a significant factor in rising inflation in the first half of the year.

RPI, the older measure of inflation still used for indexing by many pension schemes, showed an annual rate in September of 12.6%, up from +12.3% last month. RPI is at its highest level since March 1981.

With the CPI figure due to be factored into the uprating of the state pension, all eyes will now be on the government to see if it fulfils its promise to maintain the pensions triple-lock and increase state pensions by 10.1%.

In terms of CPI, experts said there was some hope that inflation may begin to subside in the coming months but the picture remained volatile.

George Lagarias, chief economist at Mazars, said: “Inflation accelerated slightly but remained well within the margin of expectations. Nevertheless, going forward, we believe that the pace of price rises may begin to subside.

"For one, demand is set to weaken. The market and political shocks of the last weeks, including Chancellor Hunt’s comments about ‘difficult spending cuts’, sent a powerful message to consumers that their own spending decisions would need to be constrained, if not constricted. The central bank has also flagged that it will resume its hawkish stance.

"At this point, we would not be surprised to see a demand shock in the UK in the following months. Second, the year-on-year numbers from October and on could begin to look better, by simple virtue of the base effect, as inflation had started to pick up at the same time last year.”

Kirsty Watson, chief operating officer, adviser, at Abrdn said: “This news will be the latest note in a cacophony of economic announcements to concern clients.

“With inflation now back in double digits, they’ll be turning to their advisers for help understanding what the rise means for them, and how best to protect their money and pursue their financial goals. They’ll particularly value advisers’ support in making sure they’ve reviewed every part of their Financial Planning. This includes areas that may not be front-of-mind, such as inflation-proofing any long-term saving strategies for children or grandchildren."

Marcus Brookes, chief investment officer at Quilter Investors, was pessimistic about inflation prospects. He said: “There is still some way to go in this inflation journey given the Bank of England expects it to still go higher from here. Rising food prices continue to have a significant impact and were the primary reason for the increase, while the continued fall in the price of motor fuels made the largest, partially offsetting, downward contribution.

“As we head towards the winter and demand for gas increases, we will begin to see higher energy bills really come into play. While Prime Minister Liz Truss’ energy plan means they are capped at £2,500 for now, it has been made very clear that this iteration of government support will not be in place for as long as was once promised, and this could well have a knock-on effect on inflation. The dip in inflation seen in August appears to have been a fluke, and with the rapidly changing environment we are currently living in we are unlikely to see inflation fall for some time yet."

Rob Clarry, investment strategist at Evelyn Partners, said: "Today’s data provided a stark reminder of the challenges faced by the UK economy. CPI inflation came in at 10.1%: five times the Bank of England target. It is showing few signs of slowing. While food made the biggest contribution, largely because of sterling weakness, there were notable increases across the other categories, including household goods and restaurants and hotels.

"On the plus side, the recovery staged by sterling over the last week ─ assuming it’s sustained ─ should help to mitigate the risk of further increases in import costs. The market is now expecting the Bank of England to raise interest rates by 100 bps at their next meeting on 3 November. Although the peak in UK interest rates is now expected to be around 5% instead of the 6% which was priced in the days after the mini budget."

James Jones-Tinsley, self-invested technical specialist at Barnett Waddingham, said: “This is the most important inflation reading of the year, as 12.4 million people just found out what their income is likely to be from next Spring. State pensioners should see a 10.1% increase in their payments; for those on a full state pension, this will mean a jump in April 2023 from £185.15 a week to £205.52, and an annual rise from £9,627.80 to £10,686.86.

“This does of course depend on the Government upholding the pensions ‘triple-lock’. Doing so has been a Conservative Party pledge for several months, including a promise from the new Parliamentary Under-Secretary of State for Pensions and Growth, Alex Burghart, as recently as last Friday.

“However, the Chancellor’s most recent speech cast doubt on this, and understandably so. Each 1% increase in the State Pension will cost the government an additional £1bn per year, so we’re now looking at an additional cost of around £10bn next year; this is approaching a quarter of the remaining fiscal ‘black hole’ that Hunt is looking to fill. He may take a more fiscally prudent route; a return to the ‘double lock’, this time the highest of 2.5% and either Average Earnings Growth (5.5% in the last read), or possibly the average of CPI for September 2021 and September 2022 (around 6.5%).

“’Trapped between a rock and a hard place’ is an understatement."