Rather than promote competition, Ernst and Young has forecast the RDR will turn customers away from retail funds.

According to the latest forecast from Ernst and Young ITEM club, this will similarly see advisers having to turn to institutional clients instead.

The firm forecasts the RDR could cause customers to turn away from retail funds unless advisers offered lower-charge access routes to retain them.

This would affect both smaller clients who would turn to index funds rather than actively managed funds and return-focused clients who would turn to hedge funds.

It also predicted exchange traded funds could move into the retail market in 2012 ahead of this trend.

Ernst and Young therefore expects to see a significant growth in the number of low-cost active funds in 2012 as the RDR approaches.

Advisers who choose not to go down this route will turn to institutional clients who are willing to pay the higher fees and want improved returns.

Institutional funds are expected to be the main growth area in 2012/13 with retail funds not expected to regain strength until 2014.

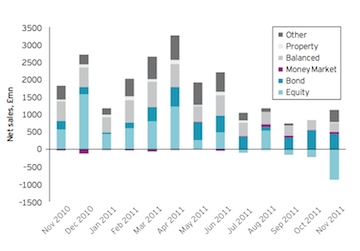

Net sales of retail funds were poor during the second half of 2011 with retail sales of Investment Management Association members dropping to their lowest level for three years in November, primarily affecting equities.

Ernst and Young said there would not be growth of retail funds until the problems in the banking sector and the Eurozone had been subdued.