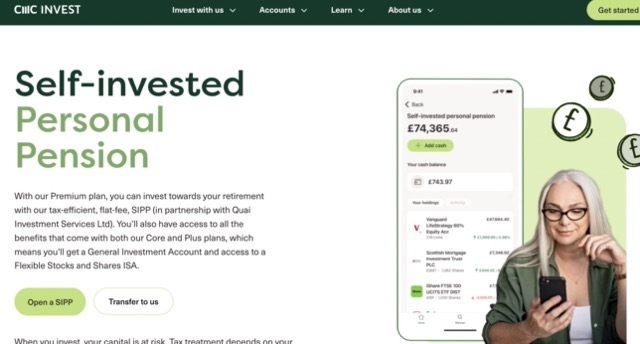

Investment platform CMC Invest has launched a flat fee SIPP in partnership with Quai Investment Services.

CMC will waive the first 12 months of fees for those accessing the SIPP via its Premium plan and then charge £25 a month plus any applicable purchase costs.

Investors can also receive up to £1,000 cashback when transferring their SIPP, ISA and/or GIA to CMC before 5 May.

Investors also get 2% interest on cash balances.

A third of investors with over £10,000 in investible assets (33%), surveyed by CMC, said they were not aware of the fees charged on their pension. This rose to 44% for female investors.

The new SIPP from CMC will charge a flat fee, regardless of portfolio size.

David Dyke, head of CMC Invest, said: “Navigating the world of pension and investment fees can be challenging and it’s natural for customers to sometimes feel overwhelmed. That’s why CMC Invest’s Premium plan is being offered with a flat fee structure.

“Regardless of your portfolio size, or how many trades you make, you’ll pay the same monthly fee. It’s easy to understand and hopefully avoids the need for laborious mental arithmetic just to figure out the cost of having a SIPP.”

CMC is a direct to consumer platform founded in 1989 in London. The company is listed on the London Stock Exchange and is also the second largest stockbroker in Australia.

Quai Investment Services Limited will act as the pensions operator and administrator for the new CMC Invest SIPP. The firm offers pension and ISA administration services for corporate clients and is based in Cambridgeshire.

People are saving more into SIPPs, according to recent research from Hargreaves Lansdown. People saved 18% more into their SIPPs between April and December 2023 than compared to the previous year.