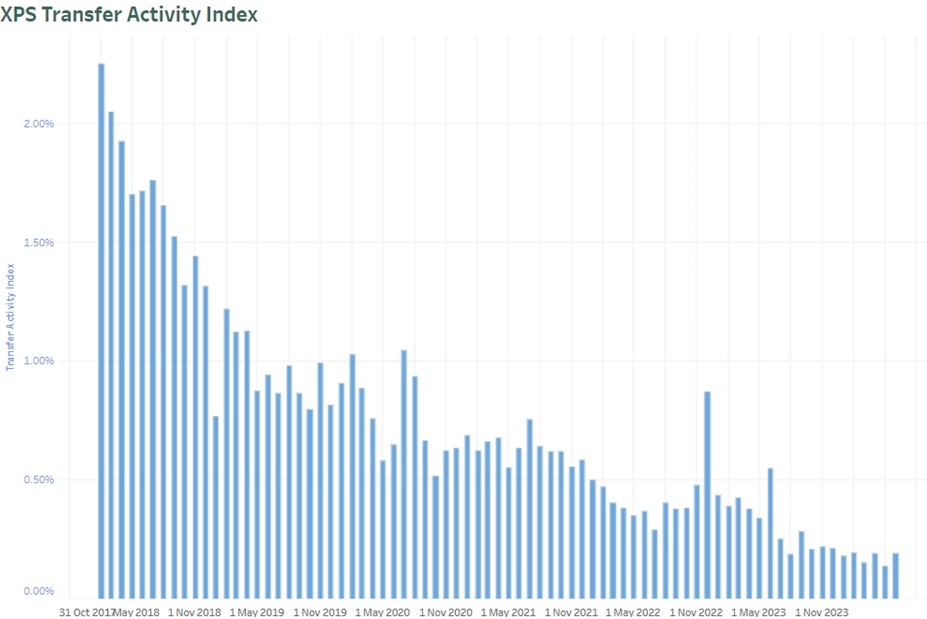

DB pension transfer activity increased ‘marginally’ in May - reversing a downward trend - with transfer values remaining stable, according to the latest XPS Pensions monthly transfer report.

The rise in activity comes after April’s record low.

XPS said the value of a typical transfer remained stable having fallen to its lowest point in six months in April.

Key findings from the report:

- Increase seen in transfer activity: DB pension transfer activity edged up in May 2024, following a record low in April, continuing a trend of low volumes

- Stable transfer values: Transfer values remained steady in May, reflecting minor increases in gilt yields and long-term inflation

- Rising annuity policy purchases: While the majority of people are still transferring to personal pensions, XPS continued to see an increasing number of pension investors opting to purchase annuity policies. It says this is likely due to more competitive pricing driven by higher gilt yields.

XPS’s Transfer Activity Index in May reached an annualised rate of 19 members in every 1,000 transferring their benefits to alternative arrangements, up from 14 members in every 1,000 in April.

Despite this, the index remained below 20 members in every 1,000 for the sixth consecutive month reflecting the continued long-term trend of low transfer volumes, XPS said.

Meanwhile, XPS’s Transfer Value Index increased slightly during May 2024 from £155,000 to £156,000 after a decline of 3.4% during April.

This marks a continued period of stability for the Index, XPS said, with month-end values fluctuating within a £5,000 range since the start of the year.

The stable picture reflects the small increases in gilts yields, coupled with similar increases in long term inflation, resulting in lower volatility in transfer values.

XPS Pensions Group’s Transfer Value Index shows the estimated Cash Transfer Value of a 64-year-old member with a pension of £10,000 a year with typical inflation increases. The value changes over time with market movements. Mortality assumptions are reviewed periodically.

According to XPS’s separate Scam Flag Index, 89% of cases reviewed by the XPS Scam Protection Service in May raised at least one scam warning flag. This represents a small increase of 1% compared to the previous month. The Scam Flag Index flags up the risk of a scam but does not imply a scam attack has taken place.

Helen Cavanagh, senior consultant at XPS Pensions Group, said: "We continue to see a long-term trend of low transfer volumes, alongside relatively stable transfer values, throughout 2024.

“Among those transferring, whilst the majority are still transferring to personal pensions, we continue to see an increasing number are opting to purchase annuity policies, likely due to more competitive pricing driven by higher gilt yields.”