Drawdown: FCA stats show 42% not using an adviser

Many customers newly entering drawdown to stay invested have not been using an adviser, new FCA figures showed this morning.

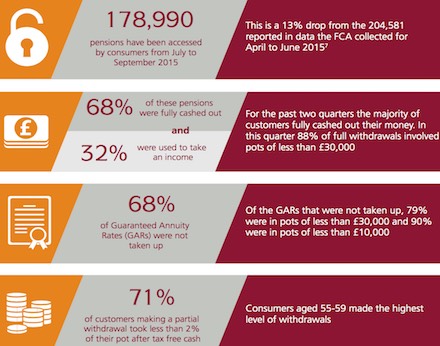

The data release for July to September last year also revealed that just 17% of consumers told their provider they had used Pension Wise. Use of the Government-backed service was higher among those with smaller pension pots where take up of regulated advisers was lower.

Customers going into drawdown were the most likely (58%) to have used a regulated adviser, the report showed, with 42% not using an adviser.

While this included customers fully cashing out via drawdown, the FCA said it showed that many customers newly entering drawdown to stay invested were not using an adviser.

Some 58% of drawdown and 37% of annuity customers used a regulated adviser during the stated period.

The FCA report said: “Customers’ use of regulated advisers differs across each product type and by pension pot size. The highest levels of adviser use were for customers going into drawdown (58%). Across all products and withdrawals, consumers with larger pots were more likely to have used a regulated adviser.”

The FCA explained that for customers entering drawdown, regulated advice may have been provided before the customer accessed their pensions savings – for example a Sipp provider selected by adviser when the customer sets up their pension.

The report stated: “We asked firms for details of when advice had been provided at the point that customers accessed their pension. In many cases providers do not capture this.

“In these cases our data shows the provider has recorded that an existing customer was advised at the point the pension was set up, not necessarily capturing whether the customer was advised when they accessed their pension benefits.”

Jon Greer, pensions technical expert at Old Mutual Wealth, said: “The FCA figures show that 1 in 5 people who fully encashed a pot of £250k or above used neither a regulated adviser or pension wise for advice or guidance. This is concerning as they would likely have been subject to a substantial tax hit on the withdrawal and there is the potential that they did not fully understand the tax implications of their decision.

“It is possible that much of this money has been used to finance buy to let investments. Research we undertook with YouGov last year highlighted that 13% of retirees intended to use their pension pots to invest in buy to let.

"However our research, and the FCA data, relates to a time before the Government announced significant changes to stamp duty on second homes and buy to let properties and we would expect to see the amount of large pots being withdrawn without advice reduce dramatically as a result.”

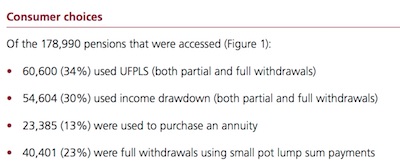

Other highlights of the report included: