A survey from an industry research provider says that ethical funds should be more popular given their continued strong performance.

Moneyfacts says that as environmental, social and sustainability-related issues increasingly take centre stage, there has been an expectation that socially responsible investing (SRI) will gradually gain a wider and more receptive audience. However, ethical funds remain a comparatively small segment of the overall retail fund market with little sign of that changing. Overall investors and advisers have failed to embrace them 33 years after they were introduced.

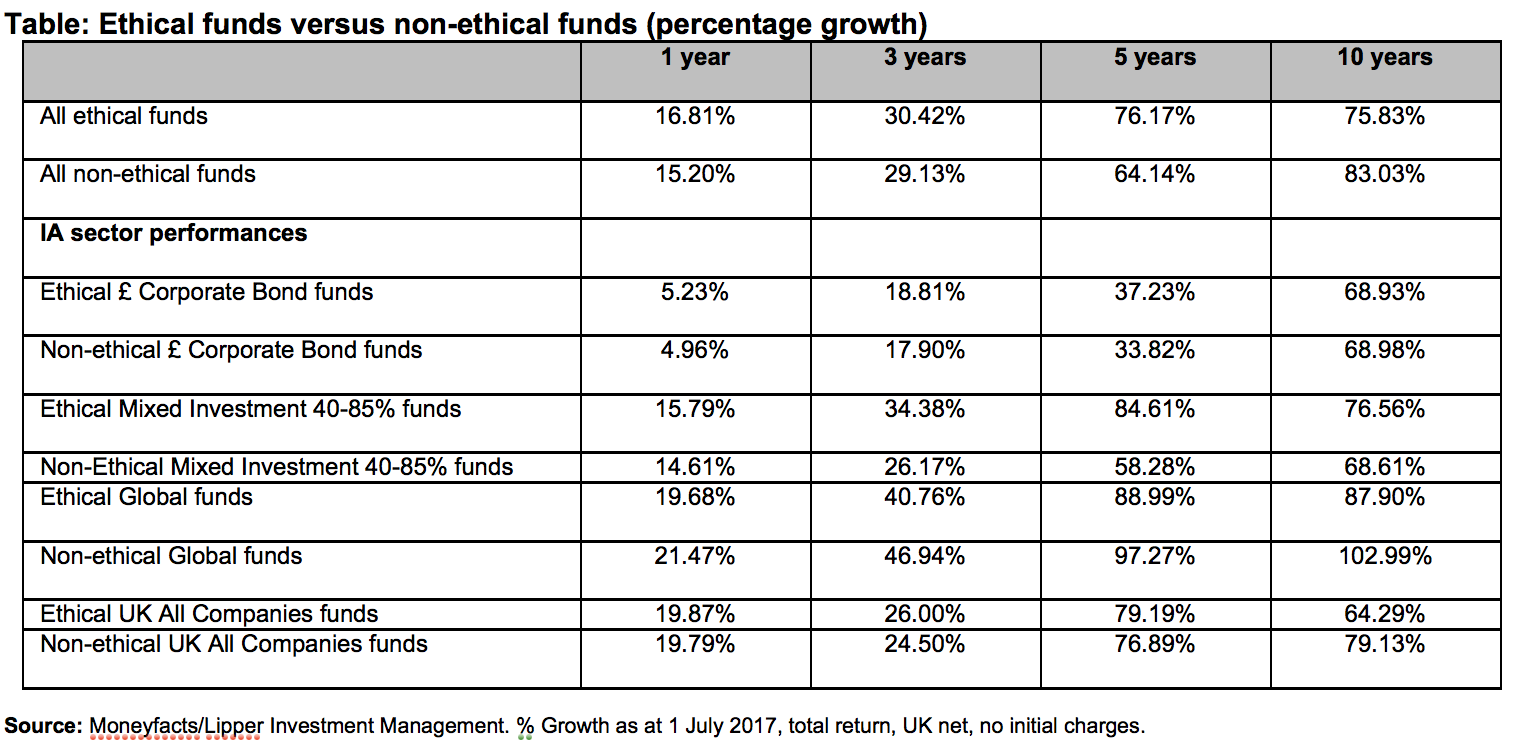

The Moneyfacts survey found that the performance case for ethical and socially responsible investing remains strong, with ethical funds outperforming their mainstream peers in 13 of the 20 scenarios surveyed.

The survey examined the performance of ethical funds versus conventional non-ethical funds over a number of investment periods. It also compared ethical funds within the four Investment Association sectors that contain the most ethical funds (£ Corporate Bond, Global, Mixed Investment 40-85% Shares and UK All Companies).

Over the past year, ethical funds have had the edge over their traditional counterparts, posting an average growth of 16.8% compared with 15.2% from the average non-ethical fund. The EdenTree Amity European Fund (33.4%) was the top performing ethical/SRI fund over the last year, although Unicorn UK Ethical Income (32.4%) and Standard Life Investments UK Ethical (30.8%) also delivered returns in excess of 30%.

Over three years, the average ethical fund (30.4%) has also eclipsed the average non-ethical fund (29.1%). Here, five ethical and SRI funds have posted growth of over 50%, with F&C Responsible Global Equity (58.4%) the standout performer.

However, it is over five years that ethical funds have truly excelled, with the average ethical fund returning 76.1%, well above the average non-ethical fund return of 64.1%.

Looking over 10 years, mainstream funds (83%) are still ahead of ethical funds (75.8%), but the margin is relatively small.

Richard Eagling, head of Pensions and Investments at moneyfacts.co.uk, said: “With every passing year, the traditional view that investing ethically entails sacrificing profits looks increasingly outdated. In our latest survey, ethical funds have more than held their own, performance-wise.

“The figures support the view that sustainable practices and good governance can give companies a competitive advantage. Indeed, as well as generating strong returns, ethical and SRI funds can play a key role in helping investors mitigate risk. Companies that fail to deliver good social and environmental performance and choose not to engage in sustainable practices are likely putting their future growth in jeopardy.

“Given the strong performance of many ethical funds and the feel-good factor associated with investing with principles, the retail SRI fund sector should have a bigger following. It is disappointing that in the 33 years since the first ethical fund was launched, ethical funds still only account for 1.2% of the total assets under management across the entire retail fund universe.”