Fears of high-impact event at highest since Lehman crash

Fears of a high-risk event affecting the UK economy are the highest they have been since the Lehman Brothers crash.

In the Bank of England’s Systemic Risk Survey, which questions 68 financial institutions twice yearly, 88 per cent of respondents thought the likelihood of a high-impact event had increased.

Some 18 per cent thought the risk was ‘very high’. This is up from zero in the first half of 2011 and the highest since the Lehman crash in September 2008.

High-impact events that firms were most worried about were sovereign risk, economic downturn, funding risk, risks around regulation and risk of financial institution failure.

The majority of respondents were worried about sovereign risk in the EU but UK-specific risks included a rating downgrade, a debt crisis or government default.

The risk of financial institution failure is new to the table for the second half of 2011, replacing risk of property price falls and financial market disruption which shared fifth place in the last table.

Other factors which were less worrying this period were household or corporate credit risk, risk of inflation or monetary or fiscal policy.

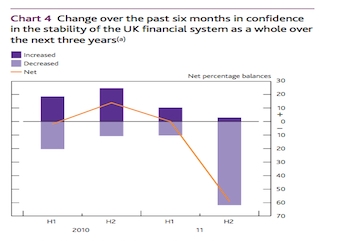

Over half of respondents reported they had lost confidence in the stability of the UK financial system, the highest since the second half of 2009.

They were also critical of regulatory rules reporting excessive and inappropriate regulation and regulatory uncertainty.