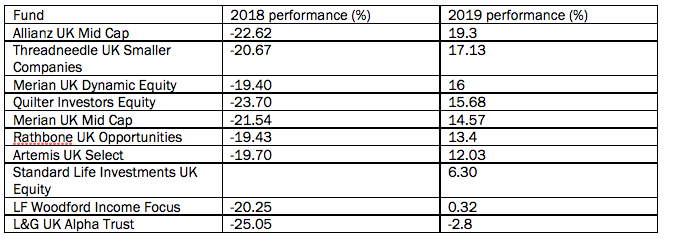

New research from Willis Owen has revealed that eight of the worst-performing UK ‘dog’ funds of 2018 experienced a “significant” rebound of up to 19% this year.

The analysis, which looked at funds in the Investment Association’s UK sectors, found that Allianz UK Mid Cap was the third worst-performing fund in 2018, returning -23%, but had bounced back by 19% since the start of 2019 to 31 May.

Threadneedle UK Smaller Companies was the second biggest gainer ahead of Merian UK Dynamic Equity in third place, boasting returns of 17% and 16% respectively in 2019 recovering from -21% and -19% the year before.

Even Neil Woodford, who has recently suspended his UK Equity Income Fund, experienced a modest uptick in performance of 0.32% this year with the LF Woodford Income Focus fund – up from -20%.

Adrian Lowcock, head of personal investments at Willis Owen, said: “It is interesting to see the LF Woodford Income Focus Fund appear in the list.

“This is the version without all the unlisted equity, being more of a core equity income portfolio.

“It shows that Woodford’s performance woes are not only due to holding unlisted stocks.

“Whilst Woodford’s view on the British economy have largely been accurate, the fund’s positioning has suffered when we reached high levels of Brexit uncertainty, such as in December and again this May, when Theresa May announced her resignation.”

He added: “The worst performers tended to invest in the more volatile, riskier mid-cap and smaller companies and have unconstrained portfolios that do not follow benchmarks.

“These types of funds are likely to suffer more in sell-offs driven by short-term changes in sentiment as investors sell first and ask questions later.

“The trigger for the recovery is different for each fund.

“For example, Merian UK Mid Cap is focused on some of the UK’s most exciting growth companies, which suffered from profit-taking last year as investors became risk adverse.

“But as risk came back on the table, the fund recovered some but not all their losses.”