Autus' classification of financial advice firms

Financial Planning firms make up the bulk of firms on the FCA register offering ‘holistic advice’, according to a new report from financial services adviser consultancy Autus.

Out of 8,257 firms which Autus classifies as offering ‘holistic advice’, 8,133 are registered as Financial Planning firms.

There are currently 2,468 directly authorised holistic Financial Planning firms registered with the FCA with an additional 5,665 appointed representative Financial Planning firms.

Among these firms there are 17,727 directly authorised individuals and 11,780 appointed representatives.

The average number of registered individuals within directly authorised Financial Planning firms is 12, of which 10 are advisers.

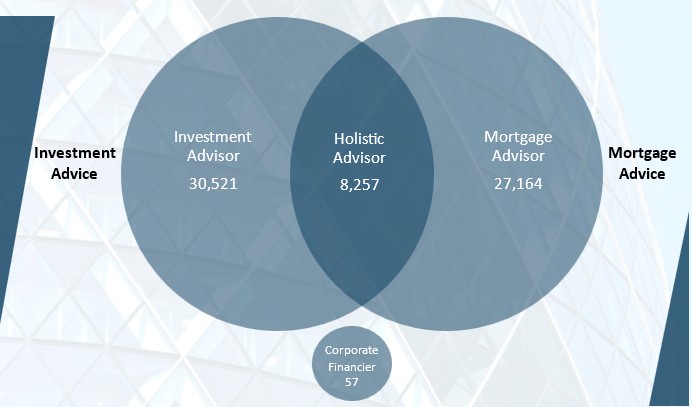

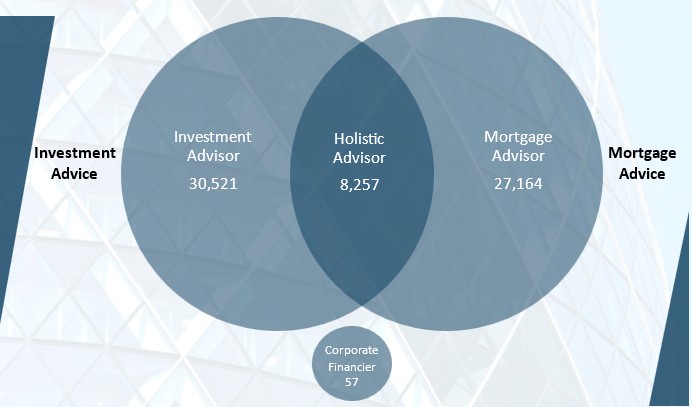

There are currently 38,612 investment advisers and 34,595 mortgage advisers on the FCA register. Of these advisers, a total of 8,257 provide both investment and mortgage advice.

The report demonstrates the impact of consolidation on the UK financial services market, with the number of firms dropping 3% over the past six months to 72,118 active firms on the register.

Over the last 6 months of 2024, 2,886 new firms joined the register and 9,989 people became registered individuals for the first time. Of the new registered firms, over 300 were investment advice firms.

While the number of firms dropped considerably, the fall in the number of registered individuals was much smaller. There were 223,724 individuals on the FCA register, a 0.5% drop over the past six months.

There were 31,000 firms with a single registered individual, a 2,000 drop over the previous six months, indicating that it is becoming increasingly difficult to operate a single adviser business.

On average directly authorised firms have 19.6 registered individuals, of which 13.4 are advisers. This compares to an average 2.1 registered individuals in appointed representative firms, of which 1.8 are customer advisers. These numbers have not changed over the past six months.

Most firms are private limited companies (77%), with sole traders at 10%.

Over 3,000 registered individuals moved firm within the last six months of 2024, with 900 of these moving from one investment advice firm to another.

St James’s Place remained the largest firm in terms of number of advisers (5,174) followed by Openwork (2,859) and Quilter (1,241). SJP saw a net gain of 52 registered financial advisers since June 2024 and now has 3,216 appointed representative firms.

Retail investment firms have seen a decrease in average revenue and profit over the past two years, according to the report.

There was a steady decline in average pre-tax profits per adviser as firms increase in size, with those with over 50 advisers being the most likely to be loss making.

According to the report, 93% of smaller firms made a profit, while 89% of firms with 6-50 advisers did so, and just 62.5% of firms with over 50 advisers.