Liverpool wealth manager Blankstone Sington (FRN 143694) has gone into special administration following a company-requested court order under the Investment Bank Special Administration Regulations 2011.

The Financial Conduct Authority has fined financial data provider Equifax Ltd £11.164m for cyber-security failures which exposed the records of 13.8 consumers.

Emma Hall FPFS, a Chartered Financial Planner at Bristol-based 75point3, has won the prestigious Personal Finance Society (PFS) Chartered Financial Planner of the Year award.

St James's Place, one of the UK’s largest wealth managers, suffered a 21% drop in its share price at one point today after announcing a review of its much-criticised fees and charges.

Financial Planner and wealth manager Quilter has added an 'App Hub' to its platform.

The Capital Gains Tax (CGT) collected from trusts has grown by 27% to £1bn over the past year, according to data released by HMRC this month.

The Financial Services Compensation Scheme has declared Cavendish Incorporated Ltd (FRN: 942176) as in default, opening the door for consumer claims against the firm.

The Financial Conduct Authority has fined former Barclays CEO James Staley £1.8m and banned him from holding a senior management or influence function in the financial services sector.

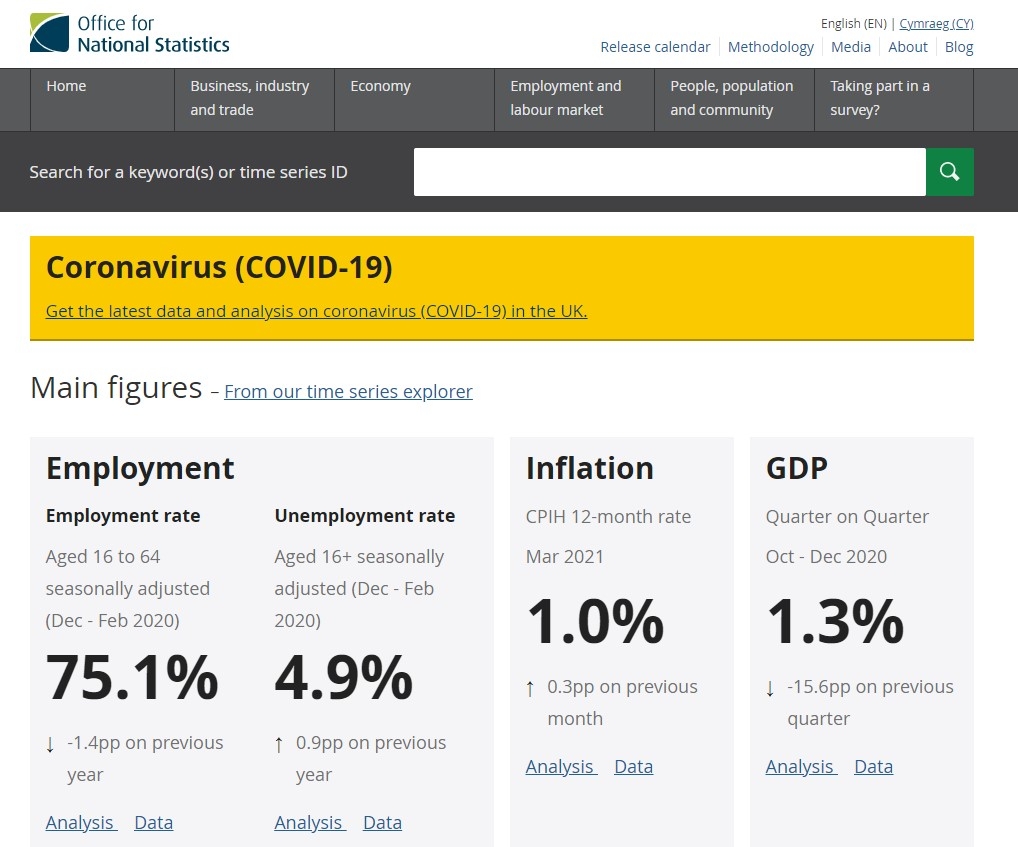

The UK economy returned to growth in August, with a 0.2% increase in GDP, according to figures released by the Office for National Statistics (ONS) this morning.

Wealth manager Charles Stanley will manage a mandate in Financial Planner Fairstone’s model portfolio service proposition.