The FCA has concluded that there is no evidence of banks denying politicians access to accounts due to their political views following an investigation in the wake of the row that erupted between Nigel Farage and Coutts Bank this summer.

The Scottish Widows Platform has added integration with two Financial Planning software providers: fintech Dynamic Planner and cashflow modelling software firm Voyant.

Wren Sterling’s summer acquisitions have added £400m AUM to the firm after it took over Guildford-based IFA Messer & Matthews in July and in August acquired a majority stake in Cornwall-based The Stockdale Group.

The amount of new business flowing into the Hargreaves Lansdown platform fell 13% to £4.8bn in the year to the end of June, down from £5.5bn in the previous year.

Fintel, owner of adviser support firm SimplyBiz and fintech Defaqto, has reported a 2% rise in revenue growth to £27.6m for the six months to the end of June, compared to £27.1m in the first half year of 2022.

One in three workers has thought about reducing or stopping their pension contributions in the last two years as the cost of living crisis has hit hard, according to Royal London.

More than nine out of 10 financial advisers believe property wealth should be a key consideration when giving Financial Planning advice, according to a survey published by a property wealth platform.

Ludlow Wealth Management, a subsidiary of wealth manager and SIPP provider Mattioli Woods, has acquired Blackpool-based Opus Wealth Management Limited in a deal potentially worth more than £1.4m.

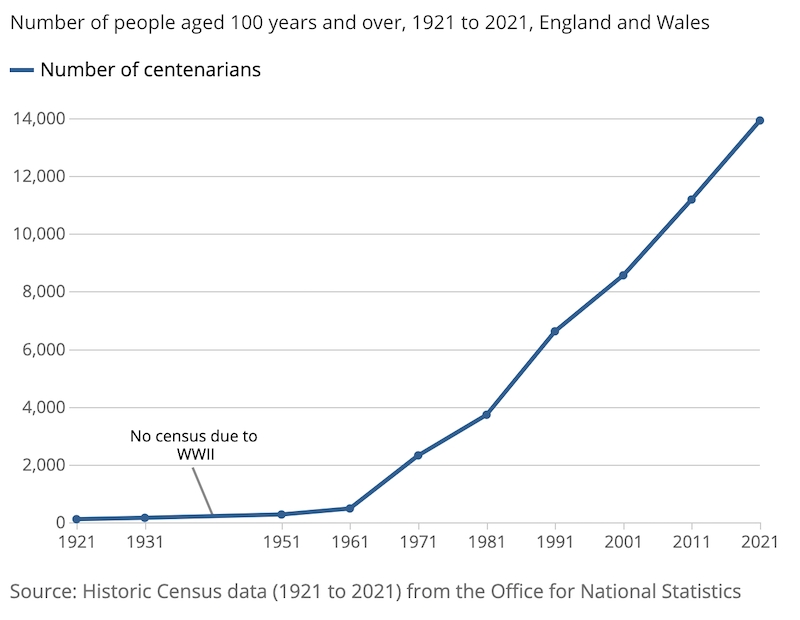

Fresh new challenges have been thrown up for retirement planning following the publication of new ONS statistics today showing that the number of centenarians living in England and Wales in 2021 climbed to the highest ever number ever recorded.

The House of Lords is due to sit today for the third reading of the Pensions (Extension of Automatic Enrolment) (No. 2) Bill - its last stage before receiving Royal Assent and then becoming law.