This is to ensure advisory firms do not receive any "kick-back payments" from DFMs in exchange for recommending their services.

The FSA said firms should already be aware of the new adviser charging rules but wanted to ensure they were "left in no doubt" about the requirements.

The rule was outlined in PS10/6 in March 2010 when the FSA said: "Adviser firms should not be allowed to receive commission set by discretionary investment managers for recommending their service, just as they cannot receive commission set by product providers for recommending their products."

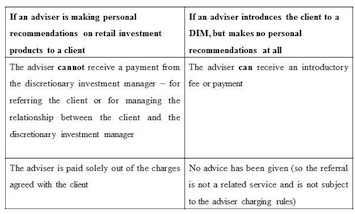

If an adviser is making a personal recommendation on retail investment products to a client and managing the relationship between the client and the DFM, they cannot receive a payment.

If they are introducing a client to a DFM without making personal recommendations, they can receive an introductory fee or payment as no advice has been given.

The ban on payments to advisers for referrals of new clients will apply from 31 December 2012.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.