GDP up but output still below pre-pandemic levels

UK GDP saw modest growth in August with an increase of 0.4% but remains 0.8% below its pre-Coronavirus pandemic level seen of February 2020.

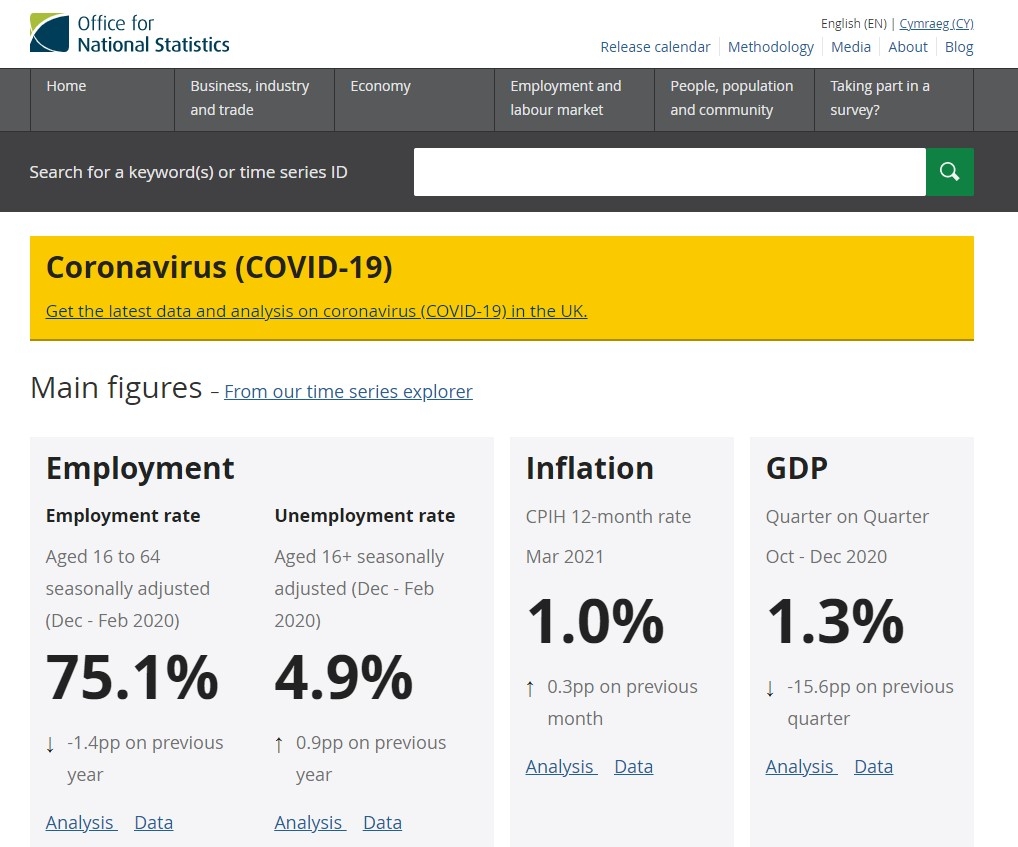

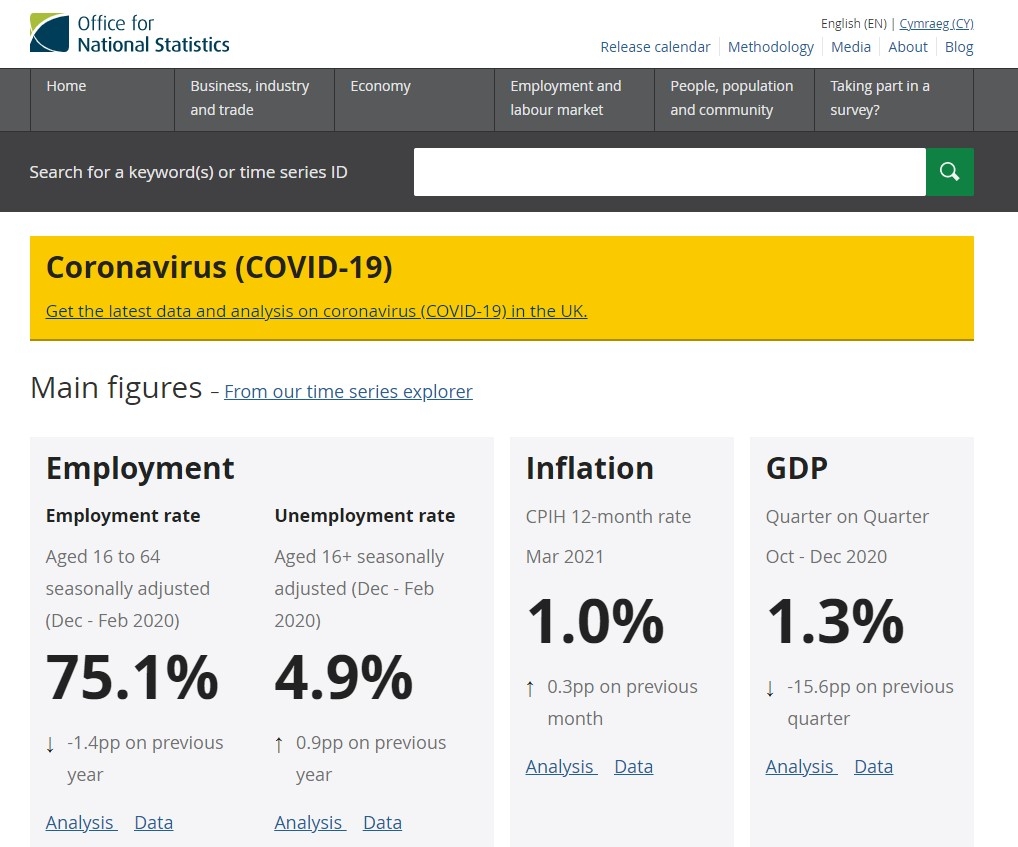

GDP growth was also revised for July to a 0.1% fall, where it was previously reported as a 0.1% growth, according to data from the Office for National Statistics (ONS) this morning.

Paul Craig, portfolio manager at wealth manager Quilter Investors, said that the UK economy appears to be coming “back to life” after the pandemic but that Brexit could still weaken growth expectations.

He said: “The creaking UK economy is taking its time to spring back to life. The problems lie now not with demand but with supply. Acute labour shortages in several pockets of the economy along with chronic skills shortages have the potential to frustrate the economic recovery, and could well dampen any expectations for a strong economic revival over the winter months.

"Once more, the UK economy will be going through structural changes as we establish our future relationship with Europe and the outside world after Brexit. This structural dislocation will no doubt weaken growth expectations.

“These environments are ones in which quality businesses can thrive, however. Those with pricing advantages and strong competitive positions will benefit from an uptick in inflation, while those with established and resilient supply chains should overcome the current issues. Investors will want to pay attention to these businesses as the recovery plays out as that is ultimately where the value will lie.”

The ONS said the increase in GDP was due to the hospitality sector benefiting from the first full month without pandemic restrictions in England.

Sarah Giarusso, investment strategist and wealth manager and Financial Planner Tilney Smith & Williamson, said that while yesterday’s official labour market report also indicates growing economic strength, the UK still faces strong economic headwinds.

She said: “The UK does still face headwinds, such as labour shortages and supply chain disruption which could lead to higher, stickier inflation. Despite this, consensus forecasts for 2021 and 2022 annualised real GDP remain firmly in expansionary territory at 7.0% and 5.3% respectively. We expect the UK economy to continue its recovery and the environment to remain conducive for equities to outperform bonds.”

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, was also cautious about the GDP figures and said the Bank of England faces some tough decisions.

She said: “It’s likely that the 0.4% growth in economic output overall in August was partly put due to the mini bounce back from the pingdemic which pushed a million people into self isolation in July. Weakness is seeping through these figures especially in the construction sector which shrank again for the fourth month in a row, by 0.2%. Widespread reports of raw material shortages is likely to have been partly to blame, as well as the difficulties of getting boots on the ground in building sites as sectors fight for skills, with 1.1 million vacancies opening up between July and September.

“Output was still estimated to be 0.8% below pre-pandemic levels in August, and the price rises, fuel shortages and labour shortages are potholes in the road which are likely to have put a brake on growth in September.

“It certainly won’t be an easy ride for Bank of England policy makers when they meet next to decide when to raise interest rates. Moving too sharply could see the economy go into reverse, but the Bank won’t want to risk losing credibility if prices keep accelerating.”

Earlier this week the International Monetary Foundation downgraded its outlook for full-year UK GDP, forecasting growth of 6.8%, below the Bank of England’s own projection for 7.25%. Overall UK GDP growth is forecast to among the highest in the G7 this year.

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/