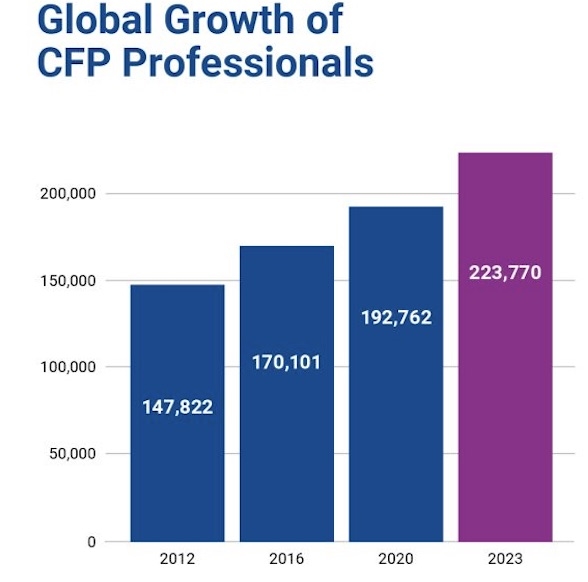

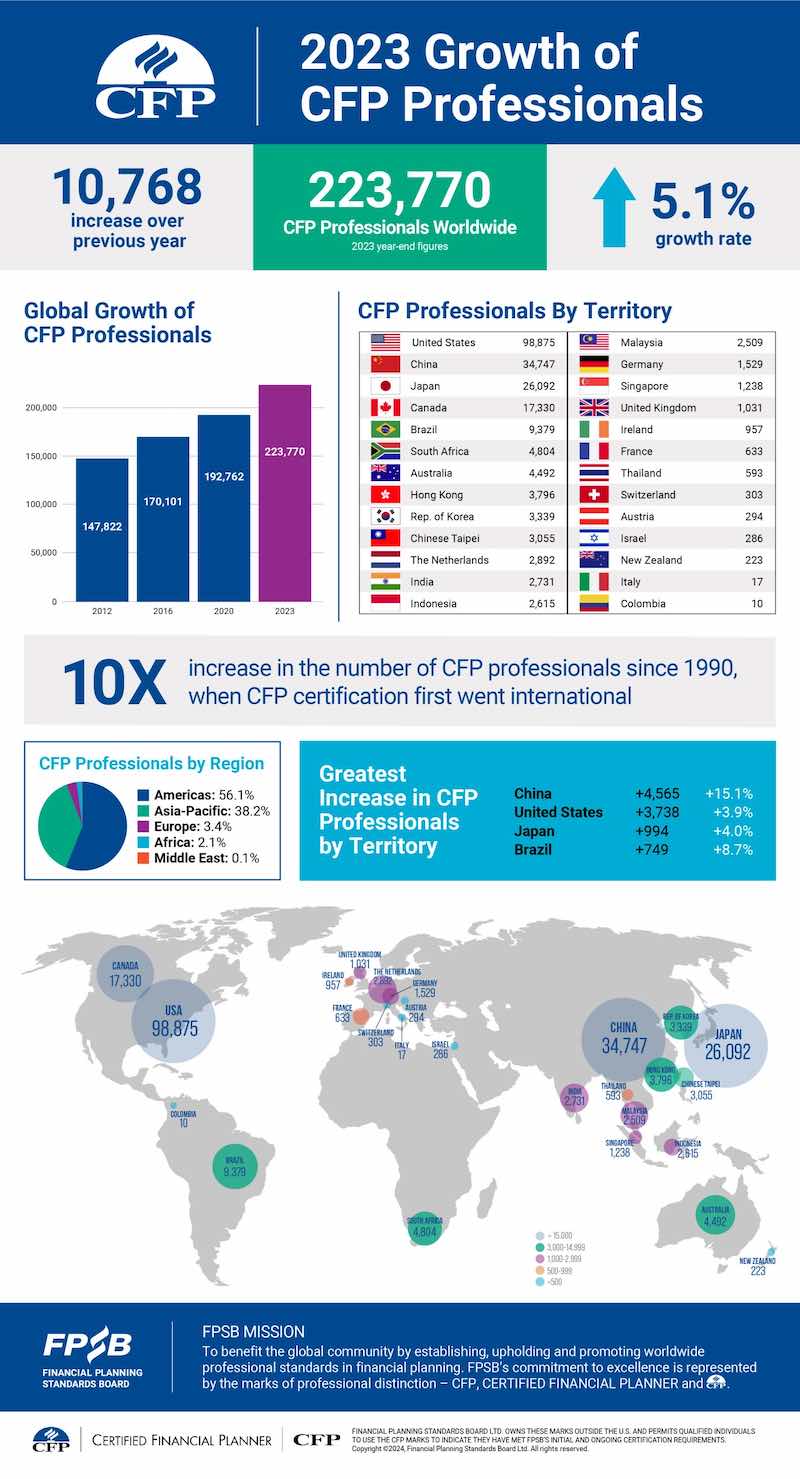

The number of Certified Financial Planner professional worldwide rose by 5.1% in 2023 to reach an all time record of 223,770.

In the UK, after years in the doldrums, numbers rose for the second successive year.

UK CFP numbers rose from 957 in 2022 to 1031, up 7.7%.

The number of UK CFP qualified Financial Planners has risen by 131 in the past two years. In the UK the qualification faces stiff competition from the Chartered Financial Planner designation offered by the PFS/CII.

The global figures are collated by the Financial Planning Standards Board (FPSB), the global CFP standards setting body based in Denver. The FPSB is responsible for the CFP qualification outside the US.

The FPSB said that with more than 50% of people around the world who have never received Financial Planning advice intending to seek it within the next three years there was lots of room for growth.

The number of CFP Professionals worldwide grew by 10,768 last year to reach a total of 223,770 as of 31 December 2023.

With strong growth in recent years, there are now nearly 100,000 CFP Professionals in the US, the biggest global territory for CFP numbers.

FPSB CEO Dante De Gori, CFP said: “We’re pleased to see the number of Certified Financial Planner professionals continues to increase year-over-year to meet the rising demand for professional Financial Planning advice.

“As the global community of CFP professionals grows, more people around the world can access Financial Planners who have committed to high standards of competency, ethics and practice to build holistic financial plans as they face increased costs of living and complex financial decisions.”

The top four growth markets for CFP professionals in 2023 were:

1.People’s Republic of China - an increase by FPSB China of 4,565 CFP professionals for a year-end count of 34,747, representing the second-largest CFP professional community in the world.

2.United States -an increase by CFP Board of 3,738 CFP professionals for a year-end count of 98,875, representing the largest CFP professional community in the world.

3.Japan - an increase by Japan Association for Financial Planners of 994 CFP professionals for a year-end count of 26,092, representing the third-largest CFP professional community in the world.

4.Brazil - an increase by Planejar – Associação Brasileira de Planejamento Financeiro of 749 CFP professionals for a year-end count of 9,379, representing the fifth-largest CFP professional community in the world.

The two territories with double-digit growth rates in the number of CFP professionals last year were Thailand (27.8%) and People’s Republic of China (15.1%), the FPSB said.

In the UK CFP numbers have hovered around the 1,000 mark for the past 10 years or more, declining slightly in recent years until a pick up two years ago. To reverse the UK decline the CISI revamped the CFP qualification, introduced new training support and launched a Level 7 standard, higher than most Financial Planner qualifications in the UK.

Sally Plant, CISI assistant director Financial Planning and education development, said: “The CFP has continued to grow on its upward trajectory now for several years. Its content has never been more relevant, with a focus on goals-based Financial Planning, while putting clients at the centre of propositions aligned to the Consumer Duty needs in the UK. Reputationally it is still the gold standard, the planner’s planning qualification from the home of Financial Planning.

“We have now reached 1,031 CFP professionals in the UK. Our Certified Financial Planner professionals are proud to be part of a community that shares best practice and interests in helping their clients achieve financial wellbeing and to live the life of their dreams. We look forward to continuing to grow the UK CFP community and encouraging our younger generation of the benefits of a career in Financial Planning.”

• Editor's Note: CISI comment added.