Tuesday, 26 February 2013 09:50

Global Financial Planners say more transparency would improve trust

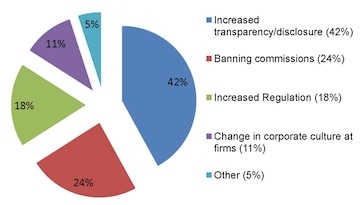

Financial Planners feel that increased transparency and disclosure would be the best way to improve consumer trust, according to Financial Planet.

The survey by the site, the blog for the Financial Planning Standards Board, questioned Financial Planners worldwide on what they thought would improve trust.

Some 42 per cent said increased transparency and disclosure followed by 24 per cent who said banning commission.

Some 18 per cent said increased regulation and 11 per cent said a change in corporate culture was needed at firms.

Phil Billingham CFPCM from Threesixty Services said disassociation from product providers was most needed.

He said: "Disclosure is a failed way of making 'buyer beware-caveat emptor' work, which will always fail. Asymmetry of knowledge is too great. To be trusted, we must be trustworthy and trust.

{desktop}{/desktop}{mobile}{/mobile}

"That means caring for our clients and distancing ourselves from those who destroy wealth, mainly product providers, especially of exotic and toxic products. Distancing means no payments of commission and taking up positions against commission in public, so Financial Planners are keen as different."

Patrick Canion CFP from Australia voted for eliminating remuneration bias.

He said: "The best way for Financial Planners to build consumer trust is to have no remuneration bias in the investments that you recommend. Make sure that, regardless of which trust, investment fund, or even class of investment your method of charging remains the same. There is no clearer signal that you are acting as a fiduciary for your client than to show that your pay is your pay, regardless of where their money is invested."

Cora Pettipas CFP from Canada said: "Being trustworthy is hard work. It means putting your client's interests before your own. It means having longer meetings where you just listen, with no agenda other than to find out as much as possible about the client and help the client focus on what they want to do with their precious resources: their time and money. Most importantly, building trust with your client means holding them in the upmost respect and protecting their personal information as well as their assets."

A vote is currently being held on the site on whether ethics can be taught. Visit http://www.financialplanet.org to take part.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

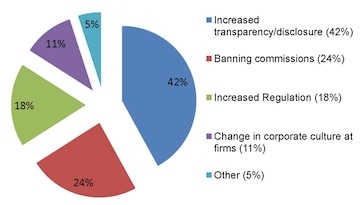

The survey by the site, the blog for the Financial Planning Standards Board, questioned Financial Planners worldwide on what they thought would improve trust.

Some 42 per cent said increased transparency and disclosure followed by 24 per cent who said banning commission.

Some 18 per cent said increased regulation and 11 per cent said a change in corporate culture was needed at firms.

Phil Billingham CFPCM from Threesixty Services said disassociation from product providers was most needed.

He said: "Disclosure is a failed way of making 'buyer beware-caveat emptor' work, which will always fail. Asymmetry of knowledge is too great. To be trusted, we must be trustworthy and trust.

{desktop}{/desktop}{mobile}{/mobile}

"That means caring for our clients and distancing ourselves from those who destroy wealth, mainly product providers, especially of exotic and toxic products. Distancing means no payments of commission and taking up positions against commission in public, so Financial Planners are keen as different."

Patrick Canion CFP from Australia voted for eliminating remuneration bias.

He said: "The best way for Financial Planners to build consumer trust is to have no remuneration bias in the investments that you recommend. Make sure that, regardless of which trust, investment fund, or even class of investment your method of charging remains the same. There is no clearer signal that you are acting as a fiduciary for your client than to show that your pay is your pay, regardless of where their money is invested."

Cora Pettipas CFP from Canada said: "Being trustworthy is hard work. It means putting your client's interests before your own. It means having longer meetings where you just listen, with no agenda other than to find out as much as possible about the client and help the client focus on what they want to do with their precious resources: their time and money. Most importantly, building trust with your client means holding them in the upmost respect and protecting their personal information as well as their assets."

A vote is currently being held on the site on whether ethics can be taught. Visit http://www.financialplanet.org to take part.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.

This page is available to subscribers. Click here to sign in or get access.