Thursday, 28 March 2013 09:06

Growing gender gap hits retirement income in 2013

The pensions income gap between men and women has grown over the past year with women's retirement incomes at a five year low, according to research from Prudential.

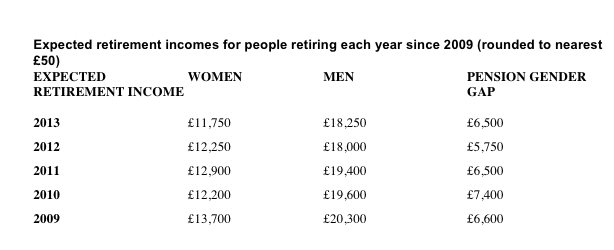

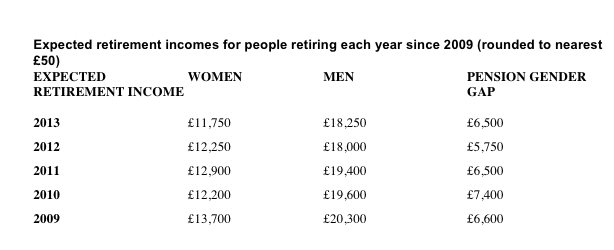

Women retiring this year expect their annual retirement incomes to be more than a third (36 per cent) lower than men's resulting in a pension gender gap of £6,500, according to Prudential.

The insurer's Class of 2013 research, the latest of the annual studies conducted by Prudential since 2008, tracks the plans and expectations of people entering retirement this year. The report found that women retiring in 2013 expect average incomes of £11,750 per year, compared with £18,250 for men.

The study shows that the gender gap is 13 per cent wider than it was in 2012 with women's expected retirement incomes for 2013 falling by £500, while men's expected incomes have increased by £250, on average.

The average annual expected retirement income for 2013 across both sexes is £15,300, including income from private, company and State pensions. Women's expected retirement incomes are at a five-year low.

Stan Russell, retirement expert at Prudential, said: "The Pension Gender Gap remains stubbornly wide. The retirement incomes of both men and women are under pressure, but for women the strain is particularly pronounced this year as their expected incomes reach an all-time low.

{desktop}{/desktop}{mobile}{/mobile}

"There are, however, practical steps that women can take today to improve their retirement incomes, including maintaining pension contributions where possible during career breaks and making voluntary National Insurance contributions when they return to work. Websites such as The Pensions Advisory Service (TPAS) - www.pensionsadvisoryservice.org.uk - ¬provide further information about the options available to women in the run up to retirement."

Prudential's study also found that 43 per cent of women retiring this year feel financially well-prepared for retirement, compared with 52 per cent of men. Just 32 per cent of women believe they will have enough income to enjoy a comfortable retirement, compared with 41 per cent of men.

The retirement income gender gap is widest in the East of England where women retiring this year expect the lowest retirement incomes of any region. In fact, they expect £10,300 less income a year than men - £9,100 compared with £19,400.

The Pension Gender Gap is narrowest in the West Midlands at £3,750. But women in the region still expect to retire on just £10,300 - the second lowest annual income of any region - while men expect to retire on £14,050, their lowest annual income of any region.

Research Plus conducted an independent online survey on behalf of Prudential between 2nd and 12th November 2012, interviewing 8,676 UK non-retired adults aged 45+, including 1,007 who intend to retire in 2013.

Women retiring this year expect their annual retirement incomes to be more than a third (36 per cent) lower than men's resulting in a pension gender gap of £6,500, according to Prudential.

The insurer's Class of 2013 research, the latest of the annual studies conducted by Prudential since 2008, tracks the plans and expectations of people entering retirement this year. The report found that women retiring in 2013 expect average incomes of £11,750 per year, compared with £18,250 for men.

The study shows that the gender gap is 13 per cent wider than it was in 2012 with women's expected retirement incomes for 2013 falling by £500, while men's expected incomes have increased by £250, on average.

The average annual expected retirement income for 2013 across both sexes is £15,300, including income from private, company and State pensions. Women's expected retirement incomes are at a five-year low.

Stan Russell, retirement expert at Prudential, said: "The Pension Gender Gap remains stubbornly wide. The retirement incomes of both men and women are under pressure, but for women the strain is particularly pronounced this year as their expected incomes reach an all-time low.

{desktop}{/desktop}{mobile}{/mobile}

"There are, however, practical steps that women can take today to improve their retirement incomes, including maintaining pension contributions where possible during career breaks and making voluntary National Insurance contributions when they return to work. Websites such as The Pensions Advisory Service (TPAS) - www.pensionsadvisoryservice.org.uk - ¬provide further information about the options available to women in the run up to retirement."

Prudential's study also found that 43 per cent of women retiring this year feel financially well-prepared for retirement, compared with 52 per cent of men. Just 32 per cent of women believe they will have enough income to enjoy a comfortable retirement, compared with 41 per cent of men.

The retirement income gender gap is widest in the East of England where women retiring this year expect the lowest retirement incomes of any region. In fact, they expect £10,300 less income a year than men - £9,100 compared with £19,400.

The Pension Gender Gap is narrowest in the West Midlands at £3,750. But women in the region still expect to retire on just £10,300 - the second lowest annual income of any region - while men expect to retire on £14,050, their lowest annual income of any region.

Research Plus conducted an independent online survey on behalf of Prudential between 2nd and 12th November 2012, interviewing 8,676 UK non-retired adults aged 45+, including 1,007 who intend to retire in 2013.

This page is available to subscribers. Click here to sign in or get access.