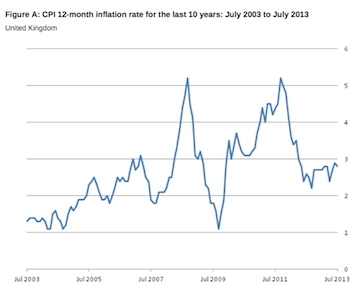

CPI inflation was 2.8 per cent in July, down from 2.9 per cent in June, according to the Office for National Statistics.

RPI inflation, which includes mortgage payments, was also down from 3.3 per cent to 3.1 per cent.

The largest contributors to CPI came from airfares, recreation and culture and clothing and footwear.

Recreation and culture fell by 0.4 per cent compared to a rise of 0.2 per cent a year ago. Clothing and footwear fell by 3.2 per cent compared with a smaller fall of 2.6 per cent a year ago.

The ONS said a fall in these sectors was not unusual during June and July.

{desktop}{/desktop}{mobile}{/mobile}

There was a downward effect from air fares which rose at a slower rate than usual. However, this was offset by petrol and diesel which rose by 0.7p and 0.4p compared with fall of 1.2p and 1.6p per litre a year ago.

CPIH, which is a new measure and includes the cost of owner-occupier housing, was 2.5 per cent, down from 2.7 per cent.

The target for the Bank of England is two per cent but the Bank has said it does not expect this to be reached in the medium-term.

The next figures will be published on 17 September.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.