Average investment advisory fees have increased by 17% over the last three years, a new report has revealed.

The ‘Investment Advisory Fee Benchmarking Report’ by Fitz Partners, a London-based research company, found that average investment advisory fees increased from 35bps to 41bps during the past three years, a rise of 17%.

However, average gross management fees dropped by 4% from 1.06% to 1.02%.

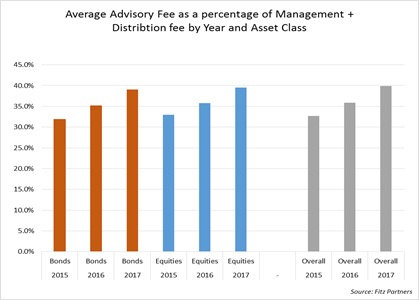

The report by Fitz Partners also found that the share of management fee, which was covered by investment advisory fees, increased by 22% over the last three years. When equity funds are taken into account, the increase drops to 20%.

Fitz Partners’ research is based on asset managers’ confidential fee schedules and exposes the true cost of investment advisory fees, according to the firm. Advisory fees, which mainly cover asset allocation and stock selection, are usually paid out of the funds’ management fees.

Fitz Partners chief executive Hugues Gillibert said: “We are seeing a further increase in one of the components of fund fees impacting funds profitability. Internal discussions in fund houses are becoming more focused. Fee benchmarking is not only a question of overall level of funds costs for investors, it is also about good business practice and margin preservation.

“Whether it is for Transfer Pricing purposes when advisory services are delivered outside the funds’ domicile or for benchmarking sub-advisors fees or internal advisory teams’ costs for profitability purposes, a close monitoring of these bundled fees has become essential.

“When looking at trends in investment advisory fees and management fees for UK and European cross-border funds, we can see clearly that both charges are not moving in the same direction. Over the last three years, management fees overall have gone down slightly while investment advisory fees have increased substantially.”

Mr Gillibert added: “As asset managers are watching their margins ever more closely, it has become essential to benchmark all components of funds’ management fees. It is remarkable to see that for many European asset managers, the part of management fees paid for investment advisory services has increased substantially and has been eating into asset managers’ margins.”