Confidence among investors is at its lowest level since May 1995, according to new data.

The Hargreaves Lansdown Investor Confidence index is currently at 44. This is a decrease of 27 points over the past month.

The index was launched in May 1995 and has not seen such low scores since a score of 52 in December 2018, at the height of the global financial crisis.

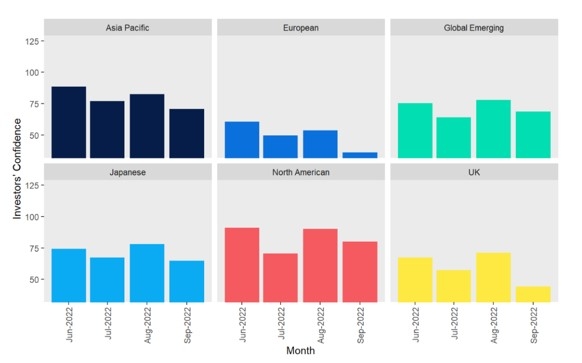

Confidence decreased across all sectors, with the largest decrease being seen for the UK investment sector.

The European investment sector also saw a particularly sharp fall in investor confidence.

Emma Wall, head of investment analysis and research at Hargreaves Lansdown, said: “There are many contributing factors to current investor malaise, but the cost-of-living crisis is the most pressing.

"Energy prices across the globe remain inflated, putting significant pressure on households and businesses, despite promises of political relief. Uncertainty around how long these inflationary pressures will last is a cause for concern, and rising interest rates provide respite for savers, but a concern for borrowers, whether it be a mortgage or corporate debt.

“Stock market performance year to date has also disappointed, meaning animal spirits are low – investors often struggle to be contrarian, and despite periods of underperformance often being some of the best opportunities to buy into markets, Investment Association fund flows reveal that 2022 has seen some of the worst outflows on record.

"All eyes will be on Central Banks and Governments to deliver a measured response to the crisis – particularly the new UK Government who are poised to deliver a mini-Budget tomorrow.”

The index also tracks the top funds in terms of net buys for the month from Hargreaves Lansdown customers.

The funds with the highest net buys for the past month were Fundsmith Equity, Lindsell Train Global Equity, Rathbone Global Opportunities, Ballie Gifford American, JPMorgan Emerging Markets, LF Lindsell Train UK Equity, Ballie Gifford Managed, IFSL Marlborough UK Micro-Cap Growth, Stewart Inv Asia Pacific Leaders Sustainability, and Abrdn Global Smaller Companies.